Amazon

Wait for a Sale

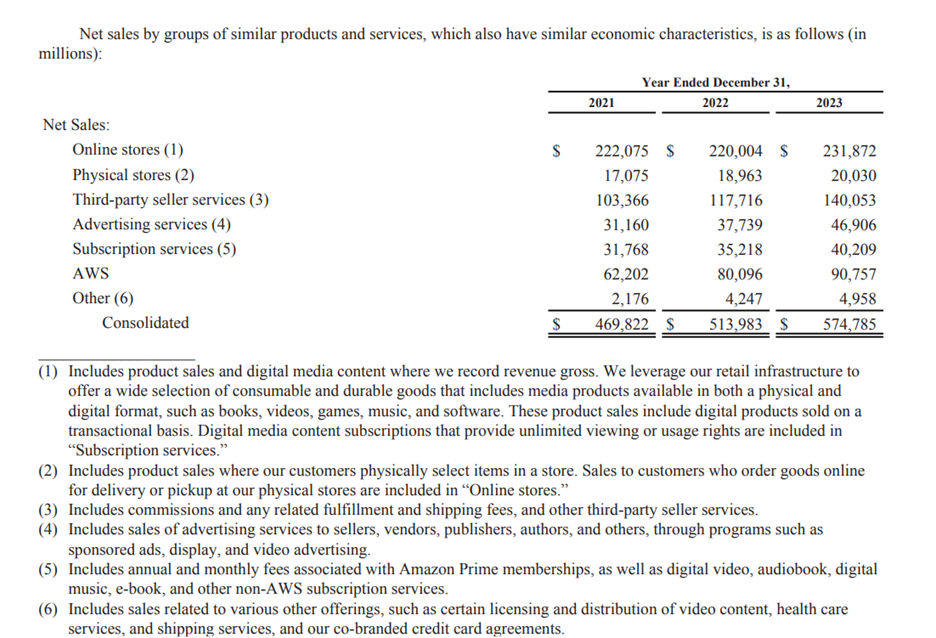

Most analysts and the media talk about Amazon as two businesses - retail and AWS. More recently, the advertising business has been discussed as a key growth driver as ad sales crossed $50B in 2024. However, Amazon themselves provide a much more granular view in their annual report, and I think investors need to think about the prospects of each of these groups (see below) in order to determine what Amazon is worth.

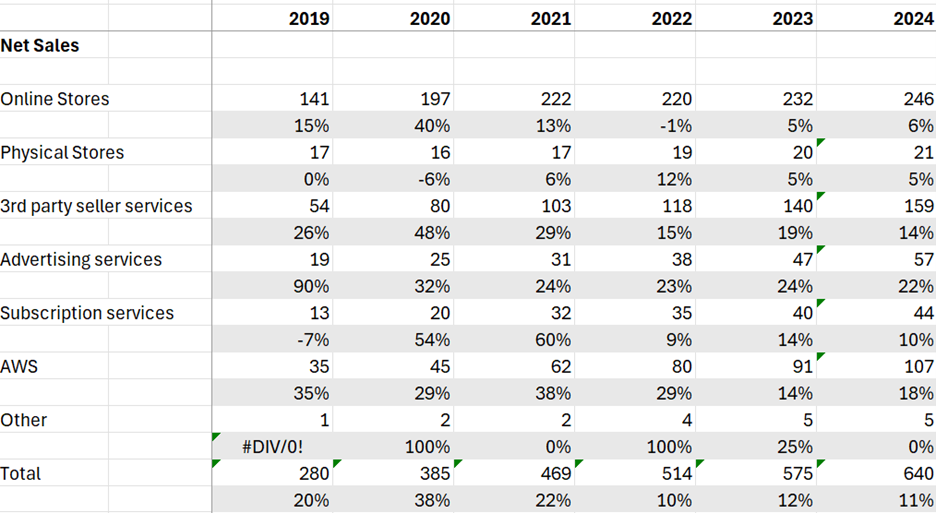

I have aggregated this group level data going back five years and the trends are fascinating.

It’s clear that growth in online store sales has slowed meaningfully in the last couple of years. About 5% annual growth for the last two years vs mid-teens growth pre pandemic.

Physical stores (Whole Foods) have always been slow growers and will be irrelevant for the purposes of this analysis because the size of the business and margins don’t have a meaningful impact on Amazon’s earnings.

Third Party seller services are still growing nicely (albeit in the mid-teens) vs 25-40% pre-pandemic.

Advertising is also growing at 20+% even as advertising services have gone from $10B in revenue in 2018 to $47B in 2023.

Subscription service growth has slowed meaningfully as Amazon has become a mature company with few large markets it can meaningfully penetrate going forward.

AWS continues to grow well and is at a $100B+ revenue run rate in 2024.

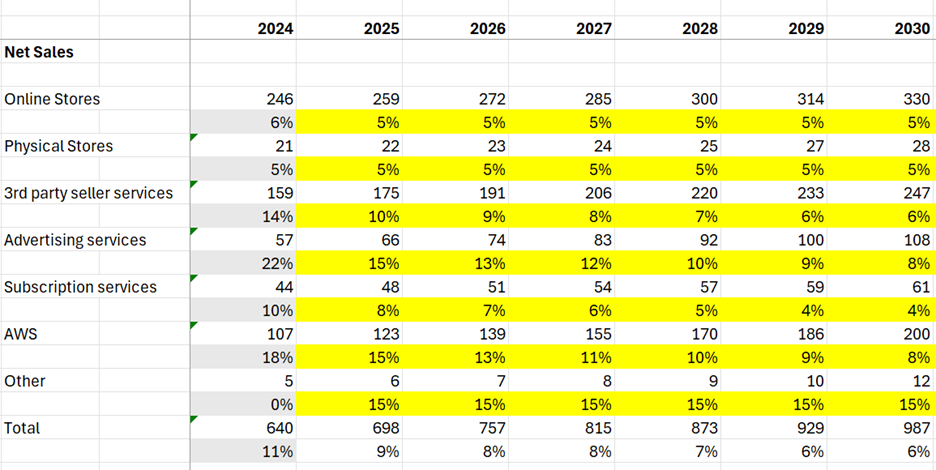

As an investor, the key to figuring out whether Amazon will be a good investment over the next five years is to have a view on how these businesses will grow and what their operating margins will be. Below is my best guess for sales growth for each group over the next five years. As always, you can download my model here and put in your own assumptions.

The next step is to have a view on margins for each of these business groups.

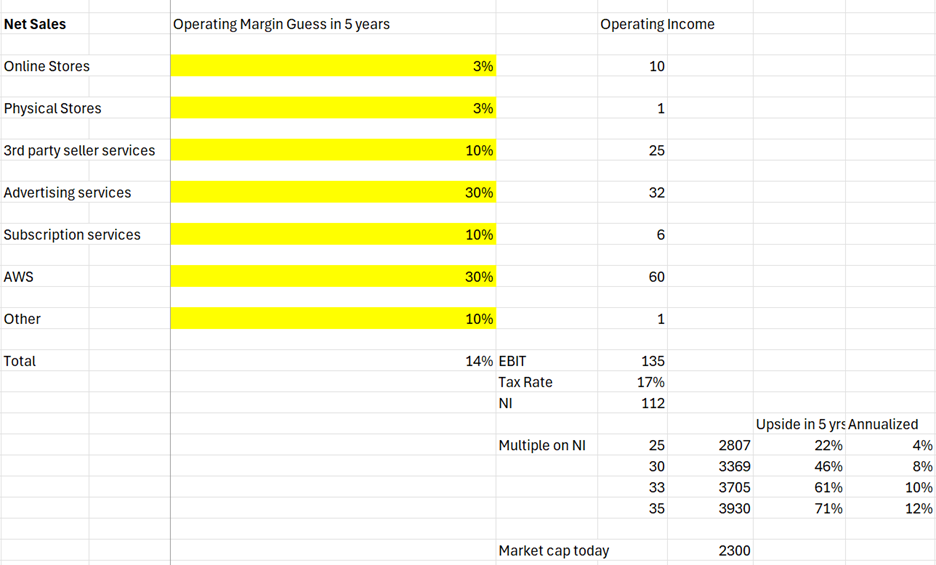

For the online stores and physical stores, I assume a 3% operating margin. This lines up with Walmart, which is one of the best run scale players in retail, so I’d be shocked if Amazon can do meaningfully better.

On Third party seller services I assume a 10% margin because of all the infrastructure costs associated with providing these services. Margins could be higher, but this seems like a reasonable guess to me.

For advertising services, I assume a margin of 30%. This should be much higher in theory, but my sense is Amazon spends a lot advertising on Google, so their ad business is pass through in a sense. The data is hard to come by, but according to Gemini, Amazon spent $10B on Google ads in 2022. It’s possible that as more people go directly to Amazon to search for goods, Amazon’s spending on Google will go down and margins on the ad business will improve.

On subscription services, I once again assume a 10% margin. In theory, this should also be a lot higher, but Amazon gives prime members a lot of ‘perks’ at or below cost, like Prime video, so I don’t think margins here are necessarily great.

With AWS, Amazon explicitly gives investors operating margins. They have averaged 30% over the last six years, so I assume this will continue going forward. In 2024, margins were closer to 38%, but its unclear if this is sustainable or boosted by Amazon investing in companies like Anthropic, which then turn around and spend that capital on AWS.

The “Other” group is too small to matter, but there is huge option value in Amazon building out a medical service provider with One Medical and Amazon Pharmacy.

Put all this together and you get a 14% EBIT margin for Amazon as a whole five years out. The final step is to put a multiple on these earnings. 30x seems reasonable given the scale and stickiness of the business, so investors should expect to compound at about 8% a year for the next five years. While this is not bad, it certainly doesn’t seem worth taking a large position in Amazon today. You can make 5% risk free for the next 10 years in treasury bonds or about 8% with relatively low risk in a structured credit ETF like JBBB (based on the current fed funds rate).

There are many assumptions here which may prove to be wrong, so I encourage you to form your own view, but this is my best guess for the moment. It will be interesting to see what the latest quarters earnings announcements bring.