Bank of America

10-15% compounder with low downside

First - disclaimer.

The bull case for Bank of America (BAC) is very simple. I expect Bank of America’s net interest income (NII) to grow by about $6B over the next couple of years. All else equal, this would mean that the net income available to common stockholders is about $33B. At a 13x multiple, there’s about 35% upside from today’s price. Add in the ~6% yield from buybacks and the dividend (~$20B on a ~$315B market cap), and you should expect to compound at 13% a year or more over the next five years.

Now let’s get into why I think NII will increase.

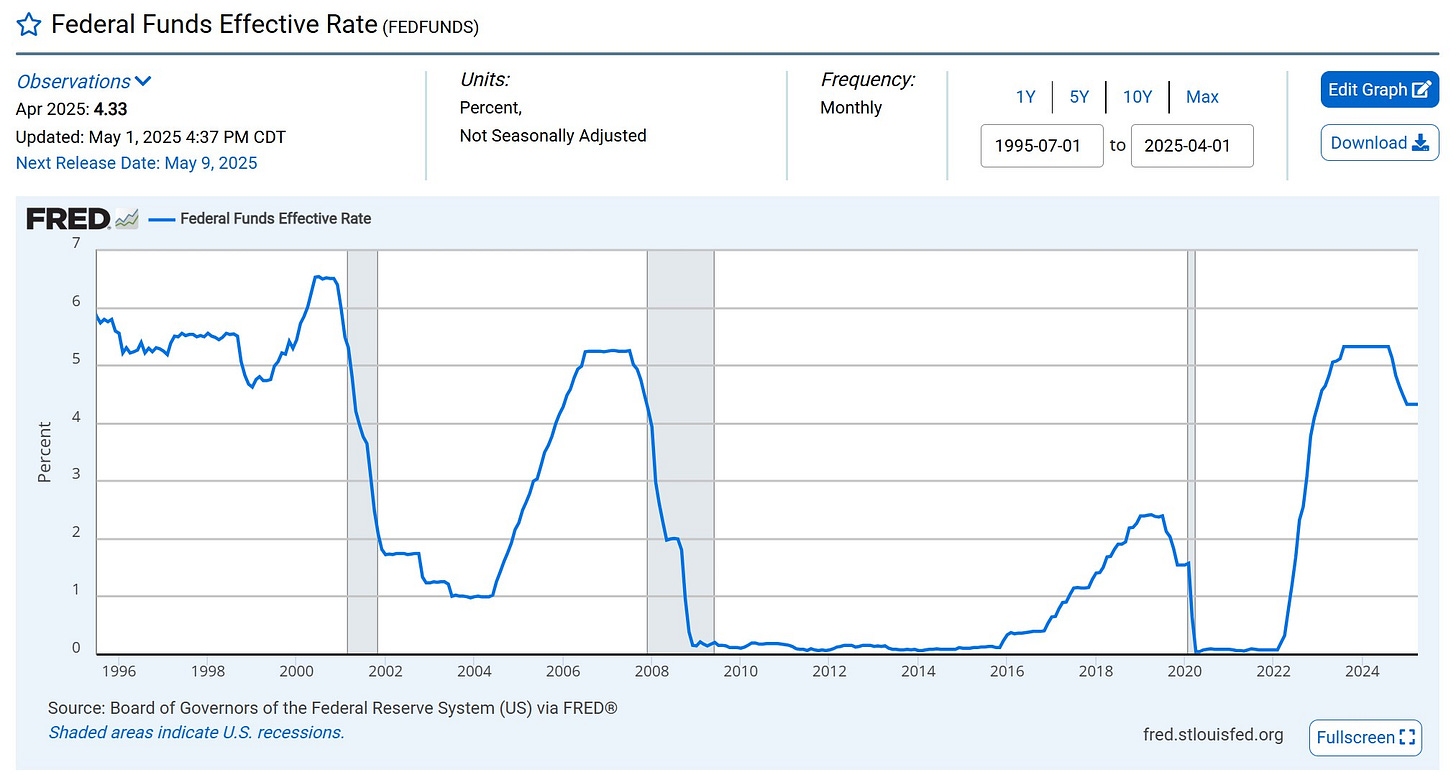

During 2020 and 2021, BAC (like JP Morgan), saw a massive increase in deposits. Pre-covid, deposits had grown about $50B a year (see model here for details), but during the COVID years they added about $500B in deposits as people spent less and let account balances build up. In BAC’s infinite wisdom, they put a large chunk of those deposits into mortgage backed securities (MBS) yielding 2.5%. In some ways this made sense because the fed funds rate at the time was effectively zero (see chart below), but others like JPM were smart enough to keep the cash on hand to invest at more attractive rates.

As the fed raised rates in 2022, BAC had locked in 2.5% for over ten years on their MBS portfolio in a market that was paying 5% over night. This meant they were under earning by about $10B a year (2.5% on $400B). Thankfully, about $35B of this portfolio runs off each year, so they can reinvest it as today’s higher rates. Over the next few years, that means about $100B in assets will be earning about 2% more than it does today, so that’s $2B of the extra $6B in NII I expect.

The other $4B comes from lower deposit costs. I expect the fed funds rate to be about 1% lower in a year from now, so BAC can likely reduce their deposit rate on $1.4T by about 50bps. This would imply about $7B in extra income, but a lower yield also affects the asset side of the business, so I’d think they can only capture about half of this as actual NII. Here’s the relevant math as described by their CFO on the latest earnings call.

Let's turn our focus to NII performance on Slide 11, where on a GAAP non-FTE basis, NII in Q1 was $14.4 billion. And on a fully-taxable equivalent basis, NII was $14.6 billion. That's up 3% from the first quarter of last year. We finished at the higher end of our expected range, and NII grew $75 million on a fully-taxable equivalent basis over Q4, even as we incurred approximately $250 million headwind from 2 fewer days of interest accrual. The improvement was driven by Global Markets activity, as well as deposit favorability and loan growth, and fixed rate asset repricing also benefited NII.

With regard to interest rate sensitivity, on a dynamic deposit basis, we provide a 12-month change in NII for an instantaneous shift in the curve. So that means interest rates would have to move instantaneously another 100 basis points lower than the 4 cuts already expected and contemplated in the April 10 curve. On that basis, a 100-basis point decline would decrease NII over the next 12 months by $2.2 billion. And if rates went up 100 basis points, again, more than the forward curve, NII would benefit by roughly $1.0 billion.

With regard to a forward view of NII, given the uncertainty of announced tariffs, we've seen expectations for more cuts and interest rates and more variability now in the market expectations for economic growth. So let us provide a few thoughts for you using Slide 12 to illustrate. In Q4, we provided our expectation that we could exit Q4 of 2025 with NII on a fully-taxable equivalent basis in a range of $15.5 billion to $15.7 billion. And that included an acceleration of NII growth in the second half of the year. Our assumptions underlying the NII belief then included an interest rate curve, which anticipated one rate cut in the middle of the year and modest loan and deposit growth. And while the interest rate environment has changed a little, our current expectation for the exit rate of NII in Q4 remains unchanged. Using the first quarter '25 as the base, the waterfall gives you some idea of our assumptions to bridge to our Q4 '25 expected exit rate. First, we pick up 2 additional days of interest, one in each of the next couple of quarters. Fixed-rate asset repricing also benefits our NII, and it takes into account the impact of the current interest rate curve. There are 3 primary buckets for that benefit: securities, mortgage loans, and cash flow hedges. Security paydowns are running about $8 billion to $9 billion a quarter. Mortgage loans are another $4 billion to $5 billion a quarter, and each gains a little more than 200 basis points as they're replaced. Cash flow swap repricing benefits are a little more staggered in their roll down and make up the rest of the benefit here. We assume the early-April interest rate curve, which reflects 4 cuts and a couple are later in the year. So that will have some negative impact near term on our expected NII growth, but it improves as the funding costs more fully reflect those cuts. The best proxy for that impact is our asset sensitivity, which again assumes instantaneous rate reductions, even below the rates cuts currently in the curve. We provide our best estimate using the timing of those cuts. And at the same time, with lower rates, we would expect just a little more loan and deposit activity, and we estimate the NII impact of that growth would offset some of the interest-rate impact from lower rates. We already saw modestly better deposit growth in the first quarter than we expected. In addition, we believe our liability-sensitive Global Markets business will also likely benefit NII more as we move through the year. And that obviously depends on the way clients choose to trade with us. Bottom line, our fourth-quarter exit rate expectation for NII is unchanged at $15.5 billion to $15.7 billion from our previous expectation. And that means we're still expecting strong full year NII improvement this year of 6% to 7%.

Here’s another way to think about the NII evolution at BAC.

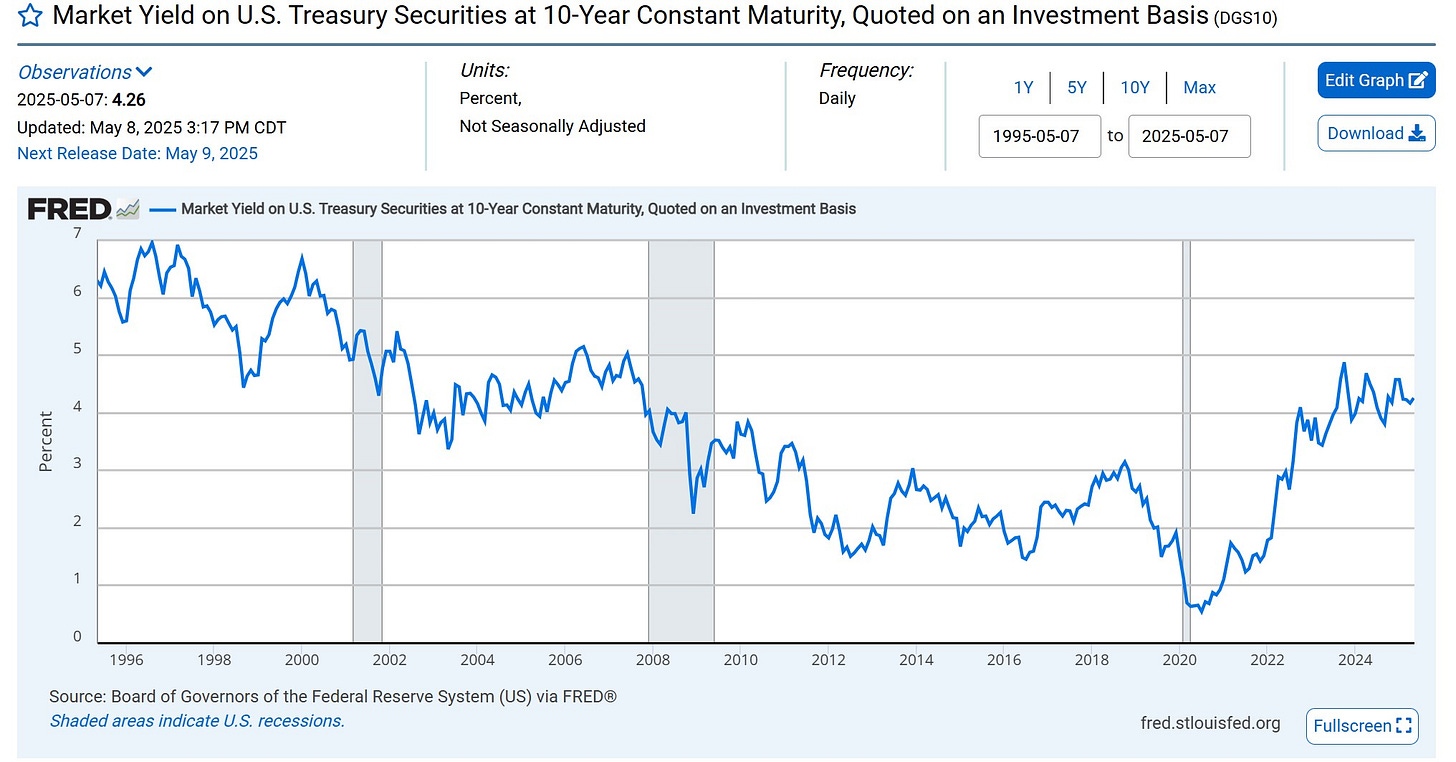

From 2013 to 2019, BAC’s effective net interest margin, NIM (as calculated in the model here) averaged 3.3%. Post COVID, their NIM has averaged 2.8%. This year it will likely come in at 3.1%. If you believe that the fed funds rate will come down over time, but the 10yr yield will stay above 4%, they should be able to go back to a 3.3% NIM in a few years. This 0.3% increase in yield on their assets would increase net interest income by ~$6B.

Well Fargo is already at a 3.3% NIM (calculated the same way), so this doesn’t seem like a big stretch.

Even if none of the growth in NII comes to pass, BAC common shareholders currently earn about $28B in net income. At a $316B market cap, the stock today is trading at only 11x net income. It’s hard for me to see it going below 10x over the next few years given the strength of the deposit franchise and the balance sheet. You may not make money buying this stock, but you also are very unlikely to lose any. Having said that, all banks are something of a black box. There could very easily be a blow up in their markets business that loses them $5-$10B in a given year. I do worry about this risk and other unknowns, so I own puts that are about 10% out of the money to hedge against this risk. The cost of these puts is only about 5% if you factor in the dividend yield over the next year, so the drag on returns is not too high.

There are several key assumptions here -

Short rates go down

I’m quite convinced inflation is a thing of the past.

House prices and rent equivalents (which are the biggest component of CPI at 42%) are falling in many parts of the country. This is especially true in the markets that went up the most during COVID. See Austin. Energy prices are also down this year and that feeds into everything in the economy from food to freight to gas for people’s cars.

Between inflation coming down and unemployment potentially going up (as companies tighten their belts), I don’t see how the fed doesn’t cut rates over the next year.

Long rates stay in the current range

The 10 year US treasury yield has fluctuated between 4% and 5% this year. I think this is about the right long term yield for an economy growing 2%-3% with a debt to GDP ratio of 120%. If this yield goes materially lower, it will be difficult for BAC to increase NII, but I think the days of sub 2% yields are a thing of the past. I could be wrong here though.

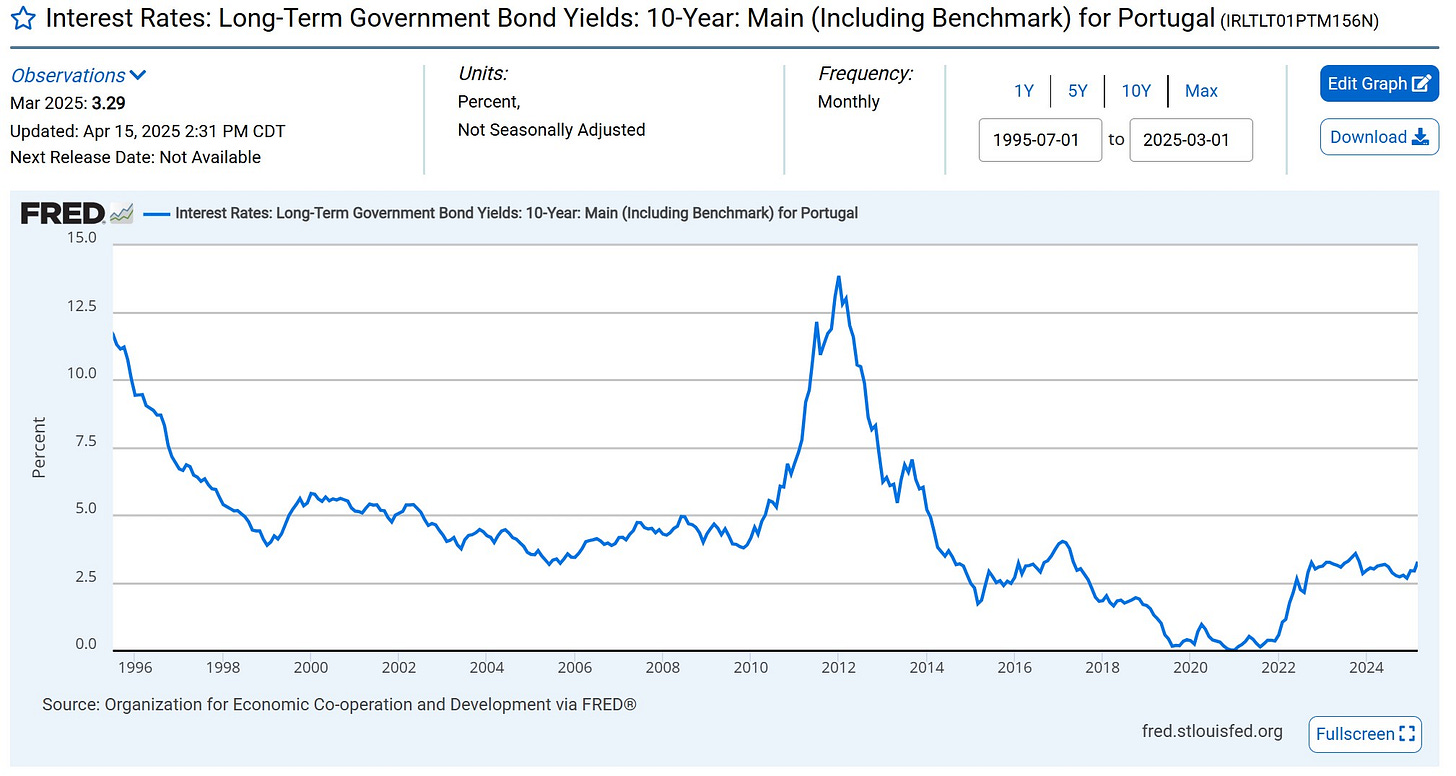

Witness the 10 yr yield for Portugal at around 2.5%. The yield was over 12% in 2012 when the world worried about these bonds defaulting. If the U.S. can get the budget deficit under control and people stop worrying about the country’s fiscal health we could easily see a ten year yield in the 2s. This would make it much harder for BAC to increase NIM, unless the fed funds rate also went down to about 1%.

Credit holds up

If there’s a big spike in defaults because the economy tumbles into a recession all bets are off on bank equity values. Bank stocks will get crushed. I think with BAC in particular, credit will hold up well even in a recession. If you look at the last 10 years, there’s been almost no grown in BAC’s loan portfolio even though deposits have grown about 50% in that period. All those excess deposits have been invested into risk free securities like treasuries and MBS, so the actual risk of meaningful defaults, I believe, is much lower today than its historically been for banks. Even in 2008, BAC had only $16B in losses on a similarly sized loan book. That’s only about half current run rate net income.

13x is the right multiple on net income

Banks have historically traded on a multiple of book value. I find this to be a bit silly given 45% of the revenue is fee based and about half the NII is from risk free assets. Given the very low growth rates of the large banks, I do think a multiple between 12x and 16x is about right. 10x feels too cheap, because there is some growth and 20x is too expensive because of the low growth rate. This is no science, but 13x is about an 8% yield (pretty good in a 4% risk free world) and in line with where Wells Fargo traded before their sales practice scandal.