Bank of America is a Buy

Price Target: $51

Given my recent analysis of J.P. Morgan I thought it would be interesting to look at Bank of America (BAC) using a similar valuation framework.

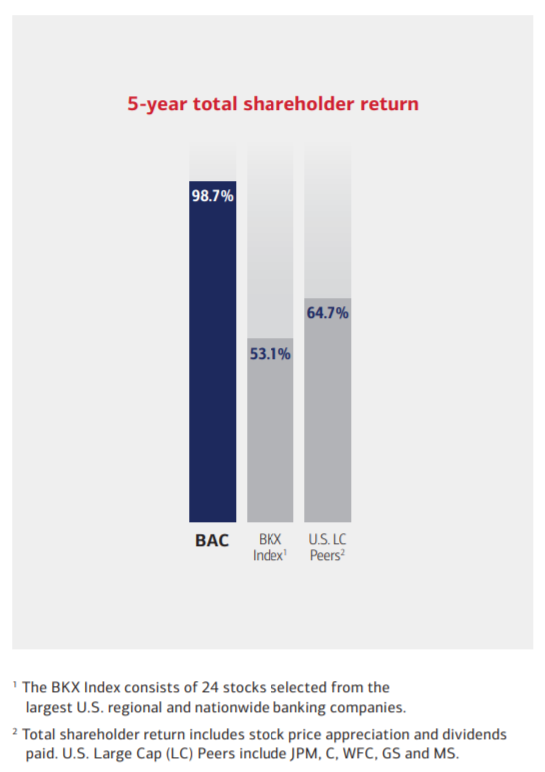

BAC has delivered steady quarterly profits since 2015 and strong shareholder returns. See charts below.

Just like with my analysis of JPM, I will attempt to make a reasonable prediction for shareholder returns going forward and apply a multiple to that number to compute a ‘fair value’ for the stock.

The Business and Valuation

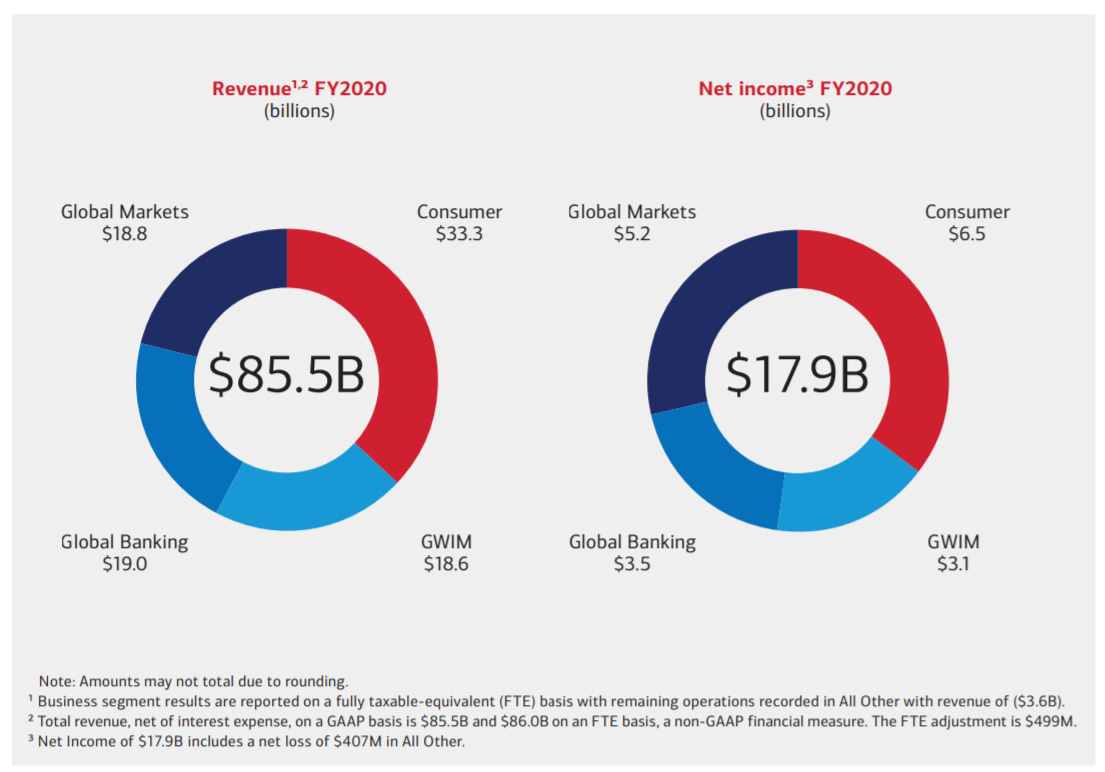

Like JPM, BAC is a large diversified bank. See chart below for sources of revenue and income in 2020.

Even though net income was down in 2020 vs 2019, the bank grew meaningfully. To quote from the 2020 annual report -

In 2020, average deposits increased 18% year-over-year to approximately $1.6 trillion. In Consumer Banking, we added $115 billion in average deposits during the year, cementing our position as the #1 bank in the U.S. by retail deposits. We leveraged our leading digital capabilities to serve our consumer clients how, when and where they chose to bank with us. Across all consumer sales in 2020, 42% of sales came through digital channels.

Expenses have also been controlled well as highlighted in this paragraph from the 2020 annual report.

In 2015, your company had $57 billion in expenses. In 2020, we had $55 billion, including roughly $1.5 billion in net coronavirus-related costs. Compared with 2015, we have more customers and clients and more transactions — so more work. Yet costs are down and headcount is down. During those six years, we invested about $18 billion in technology initiatives, added 15% more sales teammates, opened 300 financial centers and refurbished 2,000 more. All of these investments were made while costs came down. We continue to apply the practice of operational excellence to enable us to produce strong returns above our cost of capital while investing back into our company and our capabilities. This will provide powerful leverage as interest rates rise and the economy continues to recover and grow

Bank of America returned $24B to common shareholders in 2018 and $33B in 2019. These were relatively good years from a banking standpoint in that rates were rising, inflation was low and the business environment was stable. I don’t expect such strong numbers going forward, but steady state shareholder returns of $22B seem reasonable to me.

Applying a 20x multiple to this number, I arrive at a market cap of $440B for BAC – about a 20% premium to today’s price. You can input your own guess for steady state shareholder returns and the appropriate multiple here.

Notes

The pandemic has forced people to get comfortable with online banking. This could mean fewer physical locations for the big banks and therefore better margins over the coming years.

In 2019, BAC spent $1.6B on marketing - less than 2% of revenue! Contrast this with Salesforce which spent 46% of revenue on sales and marketing in 2020. Obviously this isn’t an apple to apples comparison given BAC’s sales people’s salaries are not included in the marketing number, but it highlights the value of having a sticky business and strong brand.