Banks...again

Boy has it been a fun month for bank investors! Below are six month returns on the money center banks (and Ally).

1. WFC: -10%

2. BAC: -12%

3. JPM: +20%

4. C: +14%

5. ALLY: -11%

Given the recent bank failures, these are not terrible numbers. JPM and C have actually done quite well. Today’s earnings pop didn’t hurt. By comparison, First Republic Bank’s stock is down 90% over the same period!

The prevailing wisdom is that the implosion of the smaller banks could help the big banks because money will move to them and therefore, they can continue to pay zero on their deposits. Today’s earnings calls seemed to imply that the move of money to the big banks is essentially complete, so the question now is how much do deposits fall at the money center banks / now much does NIM compress if they need to pay to retain the deposits?

Some interesting stats from today’s earnings –

1. Deposit balance growth / (shrinkage) vs a year ago -

a. Citi: 0%

b. Wells Fargo: -7%

c. JP: -8%.

The drop in deposits is likely a combination of ‘excess savings’ being spent down and money moving in search of higher yield. It’s a little bit surprising to me that Citi has managed to stay flat, but maybe it has something to do with the fact that half their deposits are held overseas.

2. Q1 Net income numbers

a. Citi: $4B (excluding gains on a sale)

b. Wells: $5B

c. JPM: $13B

JPM’s results are truly staggering and reinforce the idea that as an investor, you should pay up for quality. As proof, here are 5 year returns on the same set of banks.

1. WFC: -25%

2. BAC: -2%

3. JPM: +24%

4. C: -29%

5. ALLY: -3%

JPM is the only bank with a positive 5 year return!

However, I’m going to go against my own advice and make an argument here for buying the dog of the bunch – Citi.

There are really two main risks to banks. Credit risk (bad lending) and duration risk (long dated assets funded by short dated liabilities).

My sense is that after the financial crises, none of the large banks were trying to make risky loans, so credit risk is not going to be a major issue. Ally is different because their loan book is almost entirely auto loans. These loans could take a hit if car prices drop significantly. Also, some portion of their loan book (they don’t say how much) includes roll overs where LTV is likely north of 100%.

Duration risk with the large banks is a little harder to determine. It’s unclear if adequate hedges are in place, but on the surface, Citi seems to have been reasonably prudent. Their HTM and AFS books, have durations of 4 and 2 years respectively. They don’t specify their unrealized losses on the HTM book, but given the duration, it’s unlikely to be more than 15%, which is an approximately $40B loss. This contrasts with a $109B unrealized loss for BAC. This could all be irrelevant if rates migrate lower and deposits at the big banks remain sticky, but the point is more to illustrate that Citi seems to have a decent ALM function.

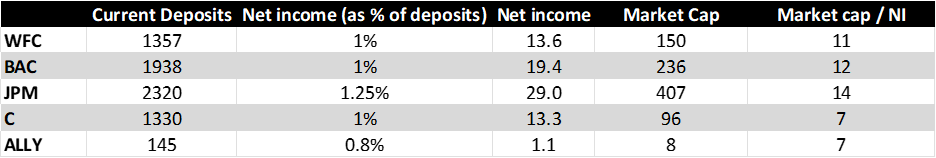

Below is a really dumb analysis, where I assume the banks can make a steady state net income equal to 1% of their deposits. This seems reasonably conservative given Wells Fargo was making 1.5% on their deposits in 1997 and 2.5% in 2007. Bank of America’s net income was almost 4% of deposits in 2007, but we know how that ended. On the flip side if deposit costs went up 1% and it took a few years to pass on that cost to borrowers, the banks would literally earn zero during that time.

It’s entirely possible I’m missing something big here given how complex these large banks are, but as you can see above, Citi is trading at seven times my ‘reasonable’ net income guess, so the risk-reward seems interesting. Its tangible common equity is 75% higher than its market cap, leaving some room for things to go wrong before the shareholders take a hit. In contrast, none of the other big banks trade at a discount to their tangible equity. This could very well mean the market sees something I don’t, so tread carefully.

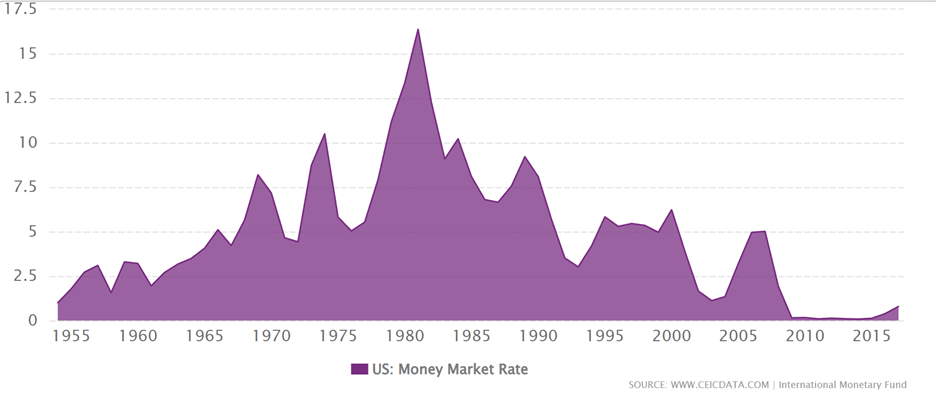

The real risk here is that the last decade was the absolute best for banks. Default rates were low because the consumer and businesses were in good shape. Net interest margins were decent because banks could pay zero for deposits. The chart below illustrates how unprecedented the low rate environment was.

The next decade could look very different.