Bet on Buffett

Price Target: $260

Berkshire Hathaway is a conglomerate with diverse business lines ranging from railroads to candy stores. It also has a significant investment portfolio which is currently worth ~$250B. Berkshire stock has underperformed the S&P 500 over the last five years, but I believe there’s 13% upside to the stock today.

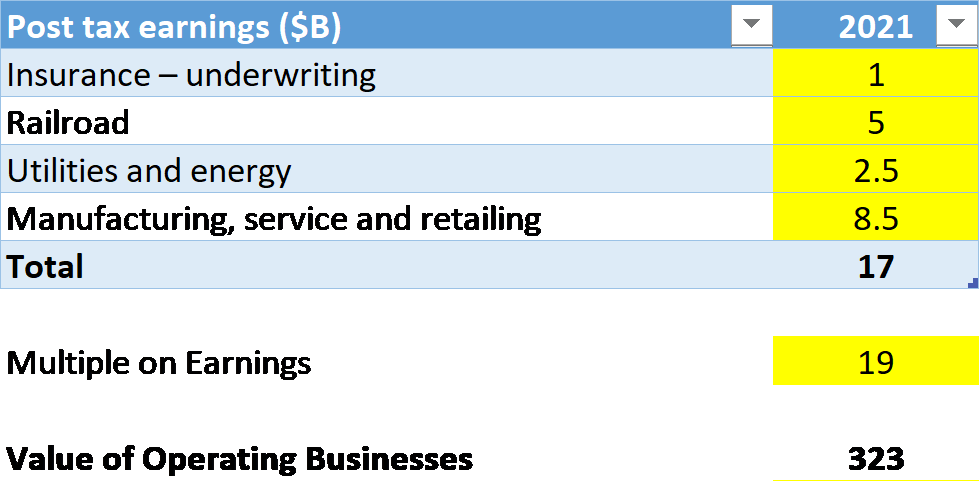

To keep my analysis somewhat simple and high-level, I’ll break down the operating businesses within Berkshire using the buckets that Buffett provides in his annual reports. We’ll make a guess for reasonable post-tax earnings for these different business lines in 2021 and then apply an appropriate multiple to these earnings to value the operating businesses within Berkshire. We’ll then add the value of the investment portfolio and net cash to arrive at the value for Berkshire shares.

Operating Businesses

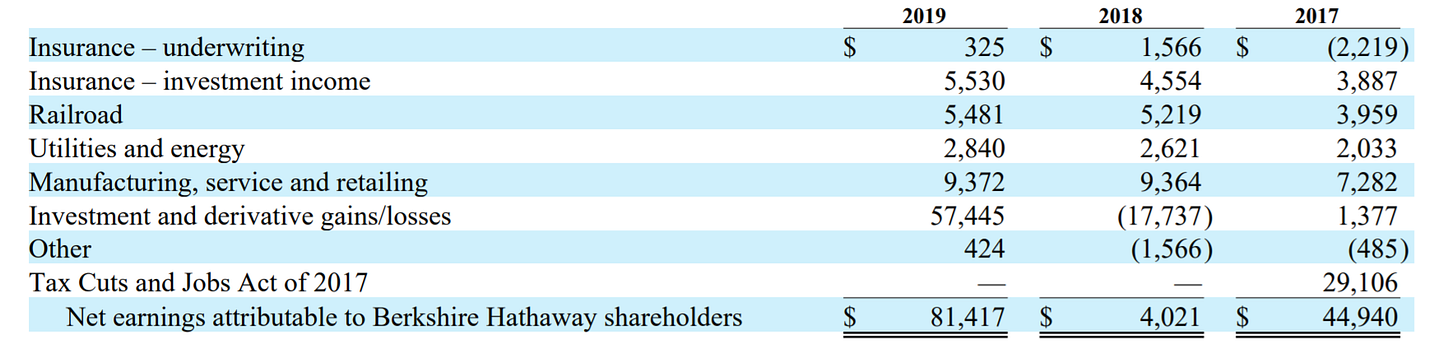

When Buffett discusses the performance of Berkshire Hathaway, he likes to break down the performance across the different business lines shown in the table below. The numbers below reflect net earnings after tax. As you can see, total net earnings have fluctuated massively in the last three years. This is because there was an accounting change in 2018 that requires Berkshire to recognize unrealized gains on the investment portfolio as net income. As a result, you see an $18B loss in 2018 and a $57B gain in 2019. There was also a one-off gain in 2017 as a result of a change to the tax code. These are obviously not reflective of any changes to the operating businesses, so we will ignore the last three lines of the table in the analyses below.

Let’s now go line by line.

Insurance – Underwriting

As you can see from the earnings over the last three years, this is a volatile business. Buffett points out in his 2019 shareholder letter that over the last 17 years, there was only one year (2017) during which the insurance business had an underwriting loss. Over 17 years, the business generated $27.5B in pre-tax profits, which amounts to $1.6B per year on average. As investors, trying to value this portion of Berkshire’s business, I would say it’s reasonable to assume this business generates $1B per year in post-tax earnings on a go-forward basis.

Insurance – Investment Income

This number primarily reflects the dividends that Berkshire earns from its investment portfolio. The investment portfolio has been built with the ‘float’ provided by the insurance business. Given this is investment income, I will choose to ignore it in this section.

Railroad

Berkshire acquired BNSF in 2010 for $44B. This is the largest acquisition Berkshire has ever made. Given the business currently generates $5.5B in after tax earnings, this was clearly a stellar acquisition. Railroads are a capital intensive business and while they compete with trucking to move goods, the cost to move a ton of goods by rail is one-third that of trucking. While I don’t expect earnings to grow at double digit rates going forward, I feel comfortable assuming this business will be around for a long time and at least grow in line with inflation. I assume $5B in post tax earnings for 2021 in my model.

Utilities and Energy

Berkshire owns 91% of Berkshire Hathaway Energy, which operates a global energy business. This includes domestic regulated utilities such as PacifiCorp, MidAmerican Energy and NV Energy. BHE also owns two regulated natural gas pipelines and the largest residential real estate brokerage firm in the US. Energy accounts for the bulk of revenue and profits in this segment.

This is another set of businesses that I expect will grow in-line with inflation, but will continue to exist for a long time. I model $2.5B in post tax earnings for 2021 vs $2.8B in 2019.

Manufacturing, Service and Retailing

The Manufacturing group includes a variety of industrial, building and consumer products businesses. The industrial products group includes companies like Lubrizol, Precision Castparts and a variety of others. The building products group includes Clayton homes, as well as flooring, roofing, masonry, and paint companies. The consumer products group includes leisure vehicles, multiple apparel and footwear makers, and Duracell.

The Service group includes NetJets and FlightSafety, as well as franchises for restaurants, equipment and furniture leasing, and a variety of media publications

The Retailing group includes over 80 auto dealerships and a variety of home and furnishing businesses.

This is clearly not the most attractive collection of businesses. I expect that a number of businesses in the Retailing space will be shut down over time. The good news for investors is that 77% of earnings for this group come from the manufacturing companies. This group has higher barriers to entry and should grow at about 5% per year on average going forward. Assuming the retailing businesses shrink, or are divested over the next ten years, this segment as a whole should grow in-line with inflation (ignoring any accretive acquisitions).

I model $8.5B in post tax earnings for this segment in 2021 vs $9.4B in 2019.

Value of Operating Businesses

Based on this discussion of the different business lines, my prediction for 2021 earnings are below. Note that these numbers are marginally lower than 2019 post tax earnings. 2020 has seen a meaningful decline in earnings vs 2019, but my hope is that a vaccine for COVID 19 in the next year will restore earnings to levels seen in the past for most of Berkshire’s businesses.

Choosing the Correct Multiple

Insurance businesses trade at very low multiples of earnings, so 10x seems appropriate to use for Berkshire’s insurance business.

Union Pacific, which is BNSF’s closest competitor, has an Enterprise Value that is 25x average earnings over the last five years, so we’ll use 25x here.

The multiple for utilities and energy companies varies from 20-40x based on my research, so I conservatively assume 25x here.

Manufacturing companies have more conservative multiples and seem to range from 15-20x based on the business. Conservatively, I assume 15x for this part of Berkshire’s portfolio.

The weighted average of these multiples is 19x. I apply this to the projected 2021 earnings to get a value of $323B for Berkshire’s operating businesses.

Investment Portfolio and Value per ‘A Share’

The current value of the investment portfolio is about $250B.

Berkshire also has $120B in cash and about $60B in debt.

Adding these numbers to the value of the operating businesses, I arrive at a per share value of $260 for the B shares. This reflects a 13% upside to the current stock price.

As always, my model is available here. This is a very simple analysis so the only real inputs are the steady state expectations for the operating businesses and the appropriate multiple to apply to them. I believe a simple analysis like this is appropriate for Berkshire, because the earnings from the businesses will grow in-line with inflation (which I also believe is the appropriate discount rate for Berkshire).

Downside Risks

Warren Buffett turned 90 this year. Investors are understandably concerned that he may not be running the company much longer. In my mind, this is similar to the concern people had about Apple and Steve Jobs. Given Apple stock is up 10x since his demise, the concern was clearly unfounded. Buffett has been pointing out for a while that Berkshire is well set up for his departure. Apple is Berkshire’s most successful recent investment and it appears that it was added to the portfolio by Buffett’s successors on the investment side (Tod and Ted). On the operating side, the vast array of businesses have operated independently for years, so Buffett’s departure should not create an issue.

Another risk with Berkshire stock reaching the calculated value in this post, is the lack of a catalyst. Unlike tech stocks, where a new product launch or a blow-out quarter could force investors to re-evaluate how much a company is worth, Berkshire is composed of slow / no-growth businesses. It is highly unlikely there will be any positive surprises. This means it could be years before the stock price reflects the calculated value. The one potential catalyst would be a meaningful share buyback program. Berkshire bought back $9B of stock in Q3 2020, which was a sign to markets that Buffett felt the shares were undervalued. The stock has gained ~10% since the buyback news came out, but the S&P is up about 8% since then as well, so its hardly conclusive that the buyback news caused the rally.

Another risk is that the stock market has a meaningful correction. This would obviously impact the value of Berkshire’s equity portfolio. However, even a 30% decline in the value of the investment portfolio, would leave Berkshire stock worth its current price of $230 per B share. This obviously assumes the operating businesses are not meaningfully impacted.

Disclosure: I am long BRK.B