Charter (NASDAQ: CHTR)

Buyer Beware

Charter and Comcast are almost identical businesses from a broadband standpoint. They each have about 30m residential broadband subscribers and they are both trying to offset declines in the video business with mobile phone customer growth.

Their stocks are also down this year for the same reason. Residential broadband subscribers continue to fall and this segment is responsible for the bulk of the free cash flow these businesses produce. This has the market spooked and as a result Charter’s market cap has halved in the last two years.

Charter is also about to complete a major acquisition of Cox, which will likely close next year barring any regulatory hurdles. This is going to dilute existing Charter shareholders, with the fully diluted share count rising from about 136m today to 197m.

In addition, Charter will take on about $16B in additional debt, bringing the total to $111B. This is a massive amount of debt for a company that is expected to produce about $3B in FCF this year.

Here is the investor presentation laying out the Cox acquisition - https://ir.charter.com/static-files/17f74638-d569-448c-be88-76d00f9c6fff

Why do I think this is an interesting set up?

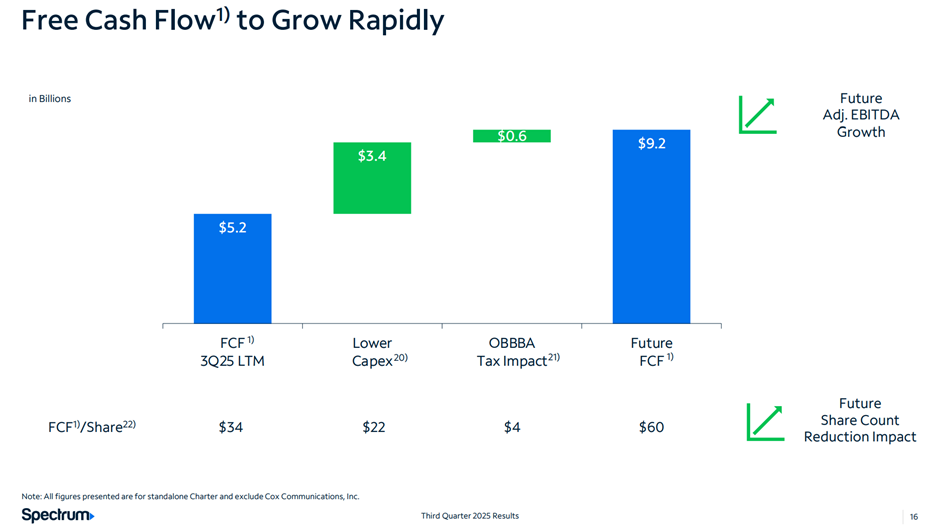

Charter management has made it very clear that 2025 is peak cap ex. They expect FCF to grow by $4B over the next few years. The exact timeline has not been spelled out, but lets say it takes them three years to get there, my sense is they’ll be making $7B in FCF. They are claiming FCF of $9B in the latest investor presentation (see below), but that assumes $5B in current run rate FCF, which I think is exaggerated. See my model here.

Even with the Cox dilution, the implied market cap at today’s stock price is $40B, so the market cap is less than 6x my expected FCF.

Charter has a solid history of buying back stock with the share count almost halving in the last seven years. If the broadband business declines at 1-2% a year as I expect, then the FCF should hold relatively steady for the next five years enabling Charter to theoretically buy back all the outstanding stock over the next seven / eight years. This would obviously do wonders for the stock price.

What are the risks?

Charter broadband subscriber losses accelerate. This would be bad, but I think internet to the home is fairly sticky for most people. If it ain’t broke, I don’t see most people making an effort to find a different provider.

A meaningful part of their broadband footprint is in parts of the country like Florida, Southern California and the Carolinas, which are susceptible to natural disasters. This could result in higher maintenance capex costs over the next several years.

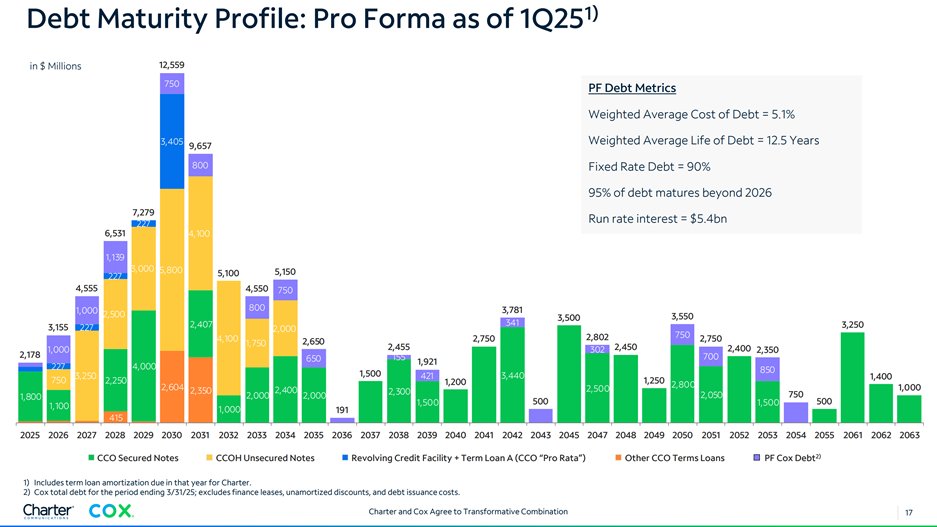

There is a massive debt maturity wall coming. See below. If debt markets freeze up, Charter’s cost of debt may double to 10% vs the ~5% today. On $40B that would be an extra $2B in interest payments, bringing the FCF closer to $5B. The stock could get cut in half again to get back to a $25B market cap post the Cox merger.

These are very real risks, so I’m going to take a very small position here just to see how things unfold with Charter over the next few quarters. Post the Cox acquisition, I think we may get a chance to acquire shares at a more attractive price.