Comcast

Broadband or Bust

If you live in the U.S., there’s a 50% chance you could get broadband internet to your home from Comcast. This is their bread and butter business, but before the age of streaming services like Netflix and YouTube, Comcast was also a dominant provider of cable TV to American households.

I’m going to skip the history lesson here because its long and complicated.

As of today, the company plans to focus on six core ‘growth’ businesses. As part of this focus, they are spinning off Versant, which will hold the legacy cable TV networks. Below are the six areas of focus –

Residential Broadband

Wireless

Business Services

Parks

Streaming (Peacock)

Studios

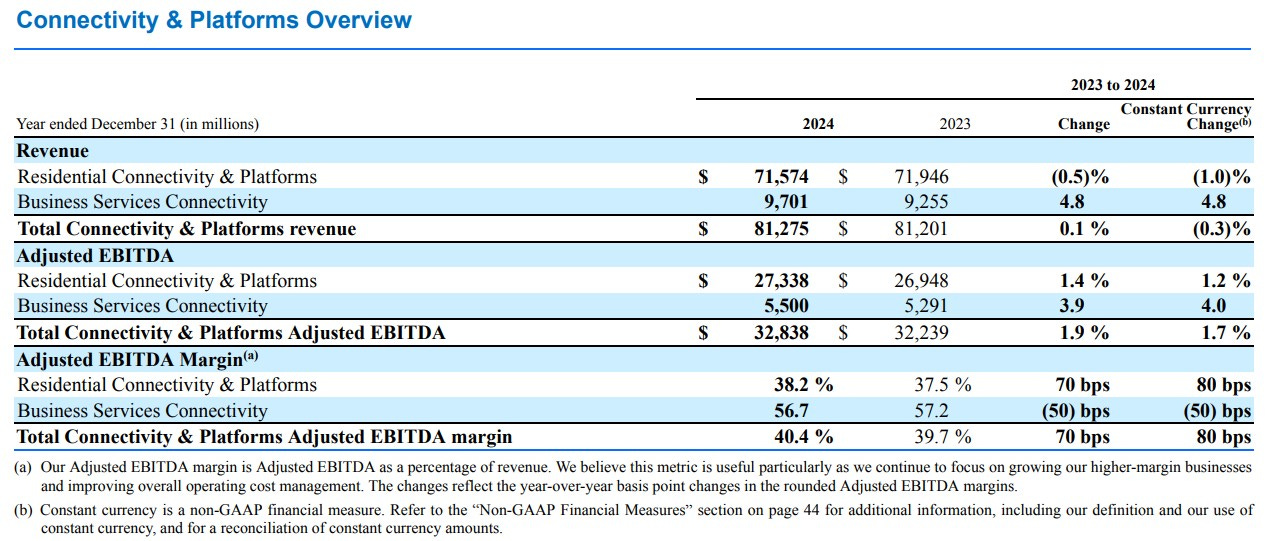

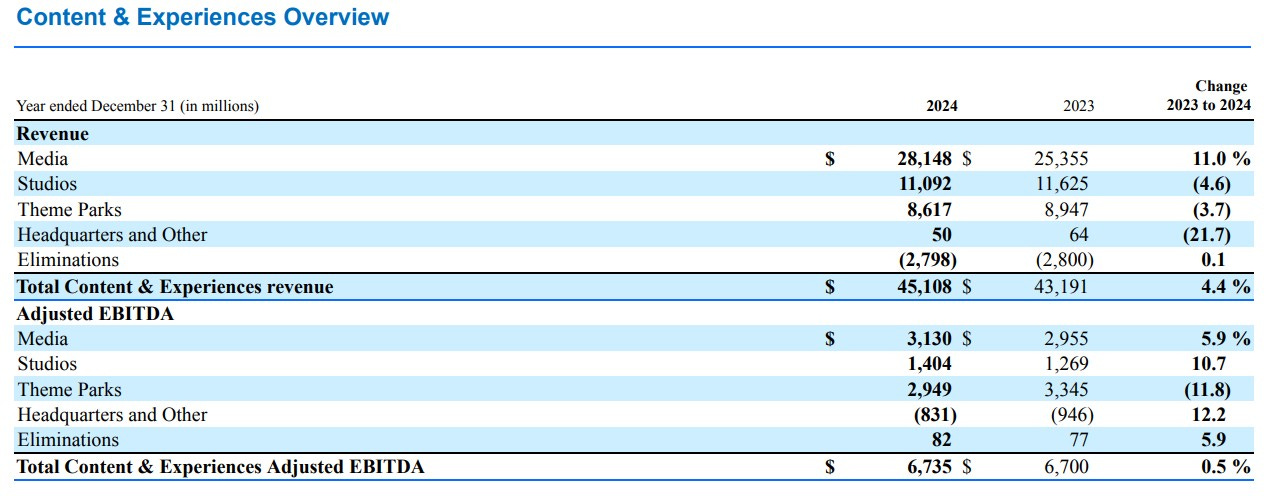

As you can see in the tables below, these six business are not created equal. The first three (bucketed as Connectivity and Platforms), generated $33B in EBITDA in 2024, while the last three (Content and Experiences), generated $7B in EBITDA.

Of the $33B in EBITDA from Connectivity and Platforms, $27B came from residential customers. As an investor trying to evaluate Comcast, the residential connectivity business is the most important one to get right over the next five years. So let’s dig in.

Residential Connectivity

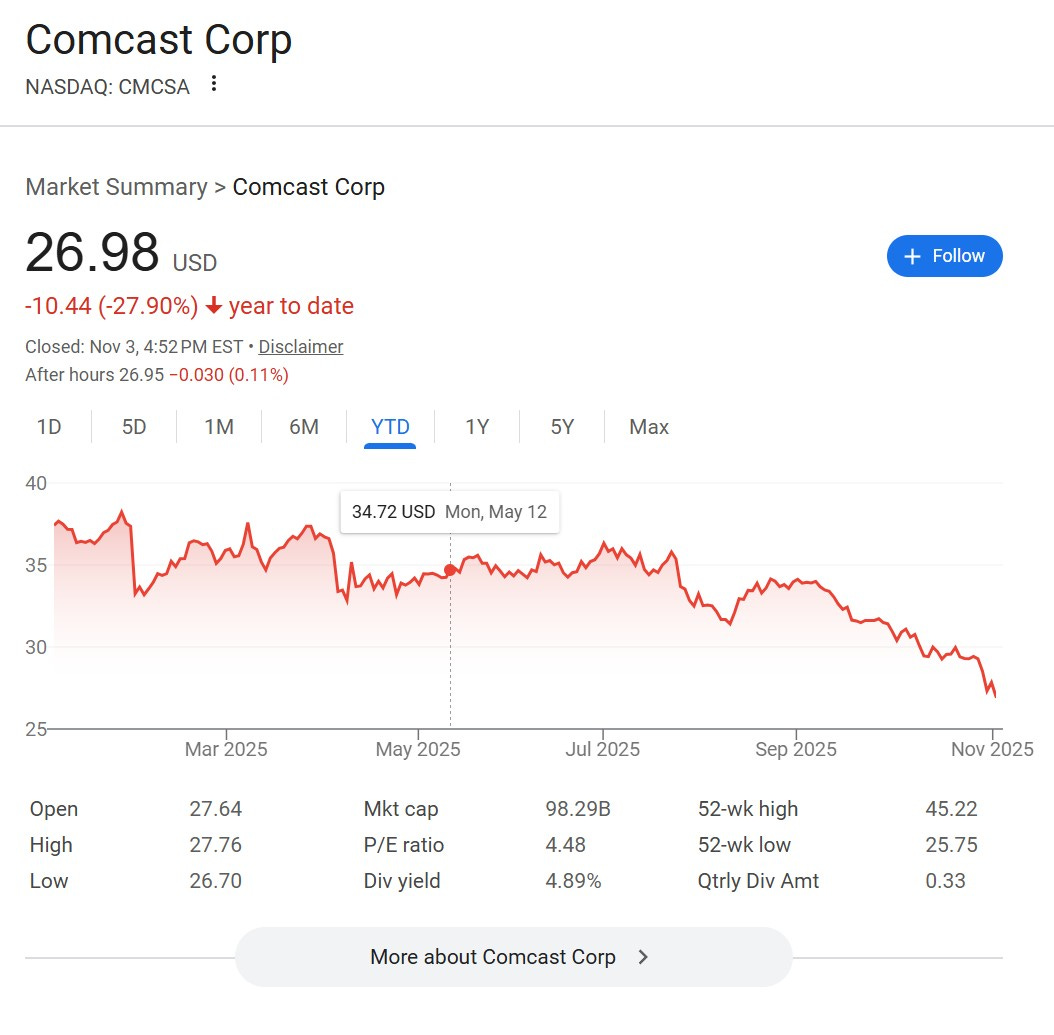

From 2016 to 2021, Comcast's residential broadband customer base grew at about 5% a year (see model here with select metrics). In 2022 and 2023, there was essentially no growth and in 2024, the number of residential broadband customers shrunk by 1%. Quarter to date this year it is down 2%. This accelerating rate of subscriber losses is what likely has the market spooked. See stock price chart below.

Comcast is losing broadband subscribers to two classes of competitors - mobile network operators (like T-Mobile and Verizon) offering a ‘fixed wireless’ WIFI service and fiber to the home providers. Speeds on fixed wireless connections are typically about 300Mbps on download vs 1Gb or more from Comcast, but there is a section of customers who will take the lower speed to save money. This is not the customer base Comcast’s CEO is losing sleep over. See comments from the CEO below at Goldman’s tech conference in September 2025.

And so our strategy on fixed wireless now has been part of the new go-to-market strategy, we’ve introduced a 300-meg tier, very simple pricing, our best device is included. And so that is to go straight at where we were weaker in the market opportunity that the fixed wireless guys have been tackling. And that’s alongside Now Internet, our lower-end brand, and Internet Essentials. So I think now we’re just getting in the market with something that is -- I think it’s still -- there’s still pressure on the fixed wireless side, but I think we’re more on footing to offer the consumer a real alternative and get them on to our system and for the future where we think there is opportunity to bring people to higher tiers.

But like you said, fiber is really the competition that we worry most about. I won’t repeat the stats about how much network used -- I got those out at the beginning, but that’s what shapes that view. And so the desire there is to just stay on top of delivering our go-to-market on the higher end and sell in wireless where we can, which is another step in that direction. And what we see, because we’ve been at it for a while, what we see in markets where we’ve been up against fiber from a telco is stable after a period of time, there’s stability in market share, and there’s healthy ARPUs.

The challenge for Comcast is its fiber competitors only seem to be investing further. See below from a Bloomberg article summarizing Verizon’s 2025 Q3 earnings.

Verizon also intends to continue pushing into home internet offerings. On Monday, Verizon announced a partnership with Tillman Global Holdings’ Eaton Fiber LLC, which will expand its broadband footprint beyond its Fios network. Verizon is additionally in the process of buying Frontier Communications Parent Inc.’s fiber network, which is scheduled to close early next year.

Verizon added 306,000 broadband customers in the third quarter. The company said more than 18% of its consumer postpaid phone customers have an offer that includes internet.

While Comcast is losing subscribers, Verizon is gaining them. This is not a good fact pattern for Comcast.

In my model, I assume broadband subscriber losses accelerate to 3% a year vs 2% currently. Comcast is doing everything they can to mitigate these losses by improving customer service and providing more transparent pricing, so this seems like a reasonable assumption to me. I also assume that video subscriber losses are offset by gains in wireless subscribers. I assume that business and international subscribers remain about flat for the next five years. All of this means that total connectivity and platform customers move up or down only based on assumptions around domestic broadband in the US. This is obviously a gross simplification, but I don’t think its far off from the reality. I also assume ARPU stays flat for the next five years because of competition and EBITDA margins drop from 40% to 39%. The margin drop is based on guidance from the latest earnings call.

Based on all these assumptions (and there are a lot of them), I see FCF from the connectivity and platforms segment dropping by about $3B in five years. Assuming the rest of Comcast’s businesses hold up, FCF for the company should go from about $15B today to $12B in five years. If domestic broadband subscribers decline at 5% a year for the next five years, FCF will decrease by $4B (all else equal) to $11B.

Given this rather unattractive dynamic, why even consider owning Comcast? Well, the price.

Valuation

In 2023 and 2024, Comcast generated about $15B in true free cash flow and returned almost all of it to shareholders. The same is set to happen this year. In my base case above, Comcast will generate about $70B in free cash flow over the next five years. In my downside case, that number drops to $60B. I think in almost any scenario, Comcast will return $10B a year to shareholders, so you’re getting a 10% yield on the current market cap of $100B. If the downside scenario plays out and the multiple on earnings five years out is 7x on $11B in FCF, you still end up with a 5% annual return. If Comcast can deliver on their vision of domestic broadband subscribers growing towards the end of next year and wireless subscribers also growing at more than one million net ads a year, free cash flow could actually end up at $15B in five years and using a 10x multiple on that, you’d make 19% a year in total shareholder returns.

While this seems like an attractive set up, management has very clearly stated that the next two to three quarters are going to be tough as their GTM changes will take time to have a positive impact. They will also only see the benefit of the free wireless line they are offering customers convert to paid in the second half of 2026. So, while I think the stock is already at an attractive level, I think it likely goes even lower over the next six months. I’ve initiated a 2% position and will add to it on any meaningful drops. I will also likely buy long dated calls once the Versant spin is complete.

I should note Comcast has $100B in debt. If the business falls apart, the equity will get hit hard because the math above only holds for a business that shrinks (or ideally grows) slowly over the next twenty years.

Risks

In addition to the $100B in debt, Comcast also has $96B in programming and production obligations (mostly live sports). If they cannot effectively monetize the content, that will create a drag on free cash flow.

The intense competition from fiber makes it very hard to handicap how Comcast’s broadband subscriber business will evolve. While the assumptions I’m making same reasonable based on current market dynamics, churn could increase if any of the large players decide to enter into a price war.