DoubleVerify (NYSE: DV)

Verify Before Buying

TLDR - While the stock could double in five years, it could also turn out to be a fraud

Unless you’ve worked in digital advertising, this is not a company you’ve likely heard of. After spending a week digging into this business, I have only a superficial understanding of what they do. The lack of transparency from management make it difficult to handicap their odds of success over the next five years.

The Business

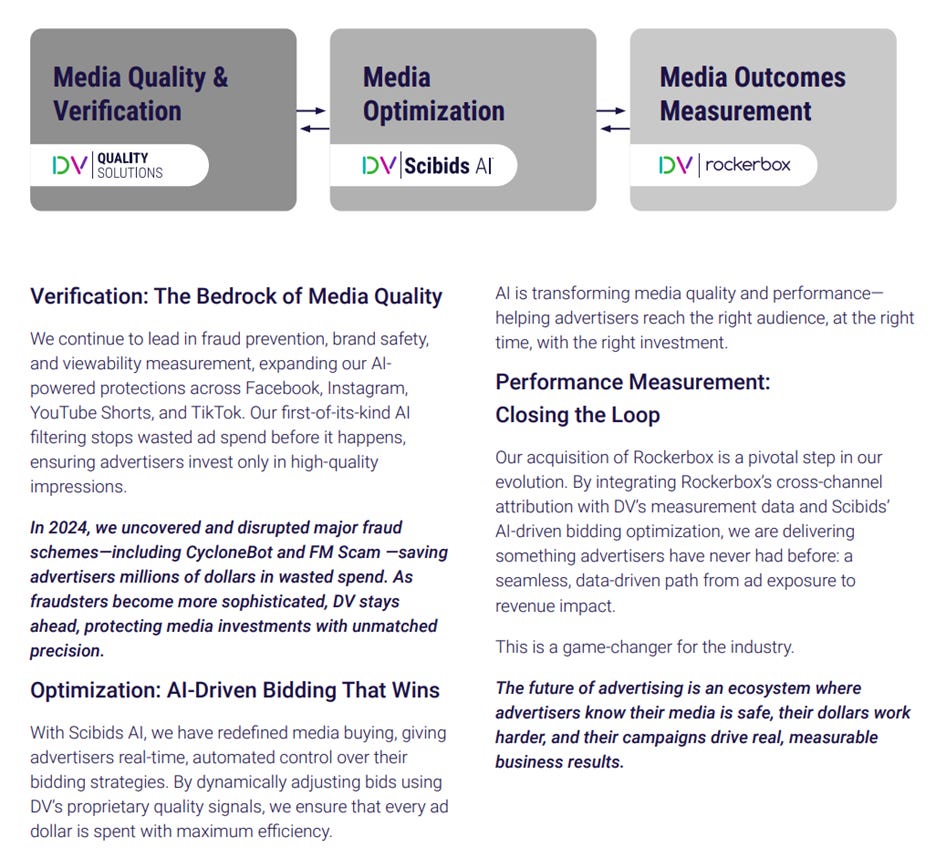

If you’re an advertiser, you can hire DoubleVerify (DV) to make sure your ads are not showing up in places that you don’t want them to. DV can also try to determine whether the clicks your ads get are from humans or bots. With their acquisition of Scibids they can help advertisers adjust their bidding strategies to maximize ROI and with their acquisition of Rockerbox they can help advertisers evaluate the performance of the ads.

Below is a quick summary of their product offerings.

While this product suite sounds great in theory, it’s unclear how effective any of these products actually are. I also think this product suite is more applicable to the open web vs walled gardens like Meta. And unfortunately for DV, more ad dollars are moving to the walled gardens. Witness Google’s shrinking Network revenues in the latest quarter vs the growth in Search and YouTube ad revenue.

As an advertiser, you may still hire DV to make sure your ads don’t show up near problematic content in Meta, but outside that use case its hard to see where the growth comes from for DV. They are leaning into connected TV, but its likely Amazon comes to dominate that ecosystem and the need for DV is limited.

In some ways DV is like a rating agency a la S&P or Moody’s. Anyone who’s worked in finance knows their ratings are essentially meaningless. By definition, the best analysts don’t work at these companies, and yet rating agencies are great businesses (with around 40% operating margins) because they provide investors with aircover if something blows up. These are CYA businesses, and I think DV is that for marketing / advertising folks at large brands.

Valuation

Unlike S&P and Moody’s, DV’s products don’t provide clear tangible metrics. It’s unclear how effective they really are and I think this will mean there is a constant need for marketing spend and product innovation and therefore margins likely remain low.

One of my main concerns with DV is just how little disclosure there is from the company on metrics like what percentage of revenue is from social media vs the web, how much is international etc.

The only useful metric they share is gross revenue retention, which has been over 95% for the past few years, so clearly existing customers see some value in the products.

I don’t find this business interesting enough to go much deeper, so this is going to be a superficial analysis. Management is guiding to about 10% revenue growth in 2026, and I assume this rate of growth continues for the next five years. I assume EBIT margins improve from 12% today to 20% in five years and the tax rate holds at about 30%. These assumptions yield about $170m in net income. Assuming a 20x multiple (DV will clearly have proven to be a real business if these assumptions are true), you get a market cap of $3.4B. Compared to the ~1.7B EV today, that’s a double in five years. You can use your own assumptions in the model here.

While that’s attractive, the uncertainty and opacity of this business make me uncomfortable, so I have a very small position just to see how things evolve.

Notes

1. Providence Equity Partners, which acquired a majority stake in DV in 2017, has sold their position down to 16% as of the most recent proxy filling. This may mean nothing as PE firms need to return capital to LPs. Or it may mean they have little confidence in the future of DV.

2. Integral Ad Science (IAS), which is DV’s closest competitor and similar in size ($600M revenue run rate), will be taken private by Novacap for $1.9B. In theory this should mean there’s a floor on DV’s stock price.

3. Spruce Point (a fund in NYC) published a short thesis on DV in 2023. You can access it here. Their thesis has mostly played out.