Facebook is Undervalued

Price Target: $330

With the NASDAQ and S&P 500 on a tear over the last eight months, it’s been hard to find stocks with growth potential at a reasonable price. Facebook, however, seems like it has a lot of room to grow and it’s not priced at a ridiculous multiple. Based on the analysis below I see 22% upside to today’s price (target price of $330 vs $270 today).

While its impressive that one third of the world’s population uses Facebook, there have always been two questions investors have struggled with –

1. How long will users stay engaged on Facebook’s properties?

2. What is Facebook’s ability to monetize these properties?

Facebook has proved remarkably adept at keeping users engaged, especially on Instagram. They’ve fended off competitors like Snap and TikTok by replicating their features and making them available to their massive audience. While it’s still possible that a competitor will emerge to challenge their dominance, their scale has reached a point where this seems unlikely.

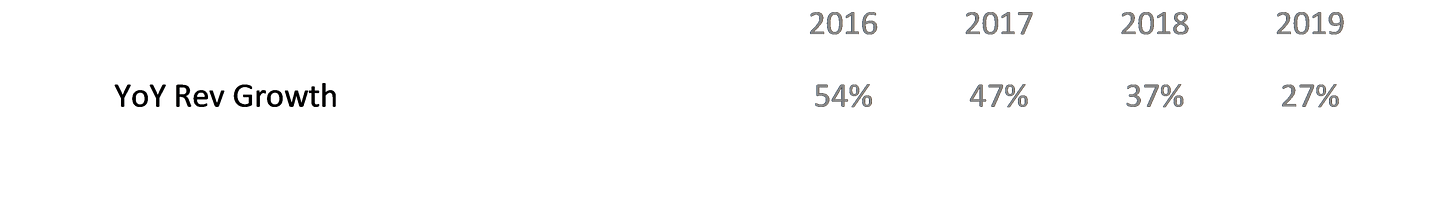

Facebook’s monetization ability was on investors’ minds recently with advertisers boycotting Facebook for not doing enough to prevent the spread of misinformation and hate on its platform. This is not the first time advertisers have chosen to stop doing business with FB. When the Cambridge Analytica scandal came to light in 2018, a group of advertisers publicly pulled ads from Facebook. While Facebook’s revenue growth rate declined in 2019, it was still a very healthy 27%. My guess is advertisers will continue to use the platform because the scale is just too compelling.

With these two significant concerns out of the way, we can move on to valuing the firm. Going forward, any references to Facebook as a business include the Facebook app itself, as well as Instagram and WhatsApp.

Valuation Based on “Reasonable” Assumptions

All of valuation is an exercise in guesswork and so the best one can do is make assumptions that feel reasonable. Below are my assumptions for how Facebook’s financials will evolve over the next 10 years.

Revenue Growth

Facebook’s revenue growth rate has declined steadily over the last four years as shown in the table below.

Facebook’s 2020 Q3 results and guidance suggest revenue will grow 18% in 2020. Without the impact of COVID revenue growth would likely have been closer to 22%. I assume revenue growth in 2021 will be 16% and decline by about 2% per year till 2024 to reach 10%. I then assume the growth rate slows by 1% a year to reach 4% by 2030. This implies average growth of 9% a year for the next ten years. Given overall ad spending in the US grew 7.5% a year over the last five years, this seems like a plausible scenario. Facebook should do better than the overall market given the scale of their platform and the fact that they are just beginning to monetize Instagram and will presumably start to monetize Whatsapp at some point as well.

As a sanity check on revenue assumptions, if global digital ad spending (ex China) grows at ~8% on average over the next ten years, it will be a ~$650B market. With Facebook revenue modeled at ~$200B in 2030, Facebook would have about 30% of the global ad market. This seems reasonable in a world where the online ad market is dominated by Facebook, Google and Amazon.

Margins

Facebook’s margins have also been shrinking over the last few years as infrastructure costs, legal costs and employee costs increase.

I assume this trend will continue, but stabilize as headcount growth slows. I therefore project margins of 30% in 2021, declining to 25% by 2025, and then staying at that level.

Capital Expenditure

Facebook’s cap ex as a percentage of the YoY revenue growth has increased dramatically over the last five years as the firm has invested in infrastructure to support its growing user base and the increased consumption of video.

Facebook forecasts ~$16B in cap ex for 2020 and has guided that this will grow going forward. Given this, I model cap ex as 150% of YoY revenue growth over the next ten years.

Given Cap Ex is depreciated over time, the impact on free cash flow is not significant, so getting this assumption right is not critical to the valuation. I model Capex being depreciated over ~4 yrs.

The Two Numbers that Really Matter

The two assumptions that have the biggest impact on the valuation are the Discount Rate and the calculation of Terminal Value.

Terminal Value

In the scenario outlined above, it seems reasonable that the market would value Facebook at 22.2x FCFF in 2030. Facebook will be doing almost $200B in revenue and will continue to be one of the platforms of choice for global advertisers. If anything, this assumption is probably conservative.

Discount Rate

The next couple of paragraphs assume that you are familiar with the traditional approach to calculating the weighted average cost of capital for a firm and using this number as the discount rate. If you’re not, you can learn about it here. If you don’t care about this topic, feel free to skip the next two paragraphs.

The discount rate is a harder number to pin down. When firms have substantial debt, it’s simple to calculate the cost of that debt and therefore factor it into the discount rate. However, companies like Facebook are entirely equity financed, which implies we would be relying entirely on the equity risk premium and the firms beta to calculate the cost of capital for Facebook. The appeal of this method is that it’s easy to get the inputs and repeat the process consistently with every company. The downside is that a measure like Beta tells you nothing about the actual risks the firm faces. It only incorporates stock price volatility versus the market. Volatility does not equal risk when you’re a long term investor.

I also prefer to be able to compare equity returns to other asset classes to decide which investments are most appealing at any given point in time. I may decide I’m happy to take the extra risk of investing in stocks for an additional 4% over the risk free rate, even though the equity risk premium at the time is 6%.

Given these issues with the classic weighted average cost of capital approach, I use the average inflation rate over the last thirty years (~3%) as my discount rate going forward. This seems like the most logical way of putting a value on future cash flows and moves the firm specific risks to the modeling of revenues, margins etc. It also adjusts for the fact that while rates are at an all-time low currently, they may not be this low ten years from now.

Valuation Results

Based on these assumptions, my value of Facebook amounts to $330 per share. This is 22% higher than today’s share price, so this could be a good opportunity to add the stock to your portfolio.

Below I discuss upside and downside factors that could affect this valuation. I’ve made my model available here, so please feel free to put in your own assumptions and let me know where you agree / disagree with my analysis in the comments below.

Upside Potential

Facebook is one of the few listed companies that is run day-to-day by its founder. He also happens to be relatively young. This should mean decisions are made with a long term view, which is beneficial to shareholders.

Downside Risks

1. Google and Apple could continue to make changes to the Andriod and iOS operating systems that make it harder for Facebook to offer targeted ads. To the extent this is true for Facebook it will be true for any future competitors as well. This could mean that Amazon and Google end up capturing a larger share of the ad market, because Amazon knows specifically what people buy on their platform and Google has a more holistic view of consumer behavior through Android data combined with Google properties such as Search, Maps and YouTube.

2. Regulations such as GDPR and CCPA could make it harder for Facebook to collect user data and therefore to offer targeted ads. The same is true of the privacy restrictions imposed on FB by the FTC. The less targeted the ads the less appealing Facebook is to advertisers.

3. Sentiment towards Facebook and user behavior could change over time with users spending dramatically less time on Facebook. This seems to already have happened with the Facebook app. People under forty in the US are barely on it. Instagram, however, continues to thrive, but it’s possible that in five years people will go from spending an hour a day on the gram to ten minutes. Given the addiction levels and most people’s willpower, I highly doubt this will happen, but it’s something to call out as a risk.

Notes

Facebook’s GAAP results show higher FCFF numbers than I do for 2018 and 2019. This is because they treat share based compensation as a non-cash expense. While this is true, share based compensation is still a real expense for FB shareholders ($5B in 2019). To keep my model simple and to reflect the realities of this cost, I don’t add it to earnings to compute FCF.

Disclosure: I am long FB.