Still Some Upside to Google

Price Target: $1993

Two weeks ago, I analyzed Facebook and concluded that the company had significant room to grow and that there was about 22% upside to the stock. Given Google and Facebook are direct competitors, I thought it would make sense to take a look at Google this week. TLDR – I see about 11% upside to today’s stock price. Keep reading for details.

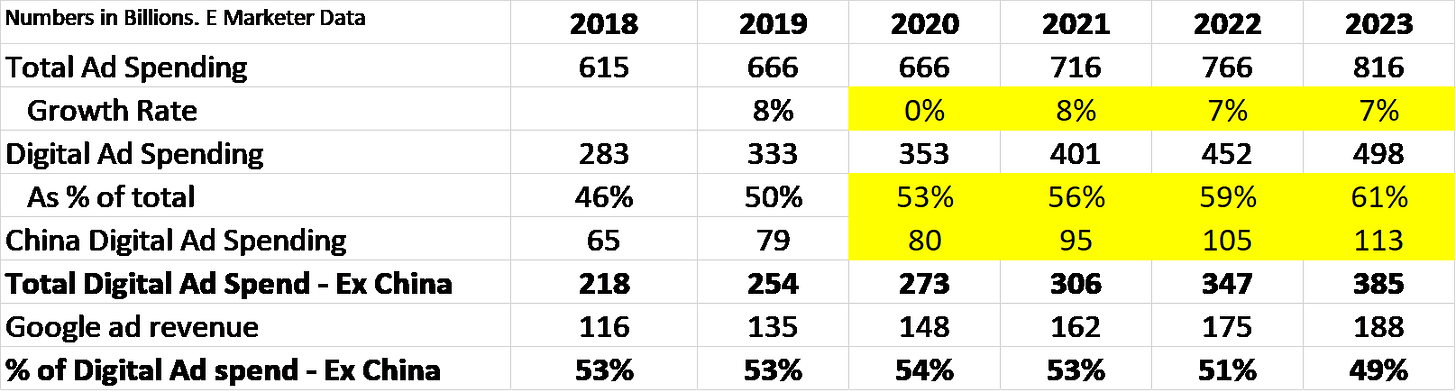

Google has a significantly higher share of the global ad market than Facebook (53% vs 28% in 2019). While this is obviously a good thing for Google, competition for ad dollars is increasing. Amazon’s ad business has grown dramatically in the past few years to $12B in 2019 (a 40% increase vs 2018). Facebook is also growing faster than Google (27% revenue growth in 2019 vs 18%), capturing an increasing slice of the ad market. Google’s ad business is maturing and therefore growth rates will slow in the years to come and margins will shrink as competition heats up.

To counter the slowing growth in the ads business, Google is investing heavily in new business lines like Cloud. Unfortunately, this is a competitive space, so revenue growth will be hard won and therefore margins are likely to be lower than the 25-30% Google has historically enjoyed in the ad business.

Let’s jump in and analyze Google in more detail.

Revenue Growth

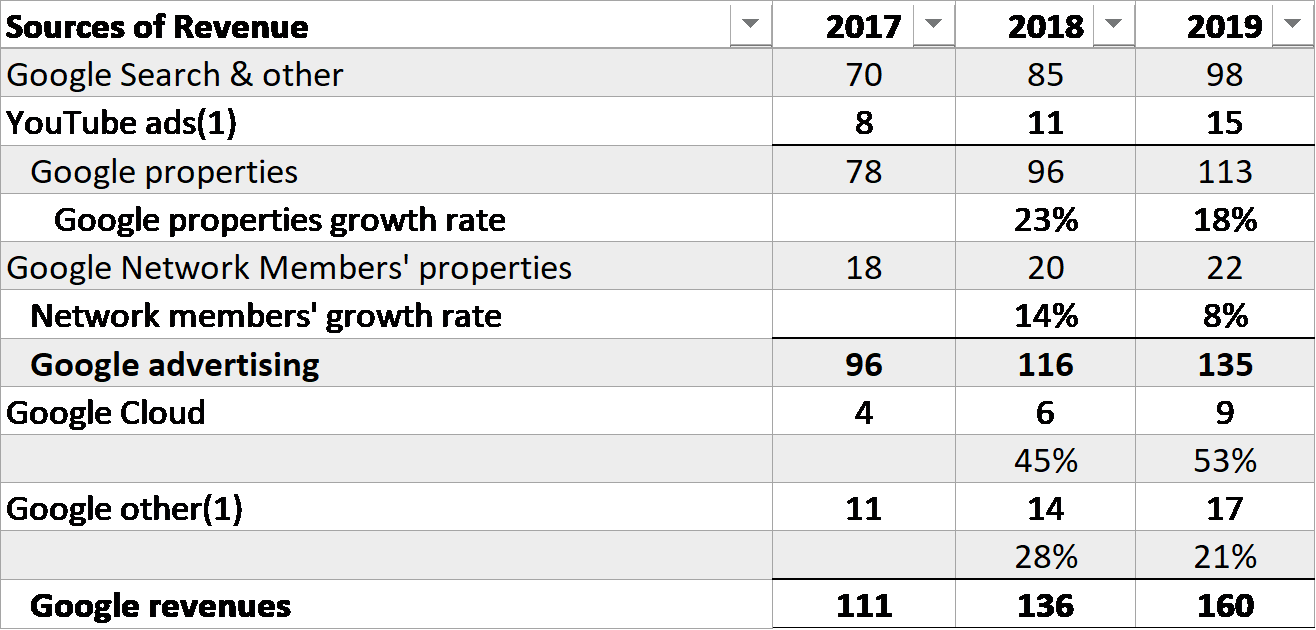

In its earnings reports Google breaks down its sources of revenue as shown below.

As you can see, 84% of Google’s revenue in 2019 came from advertising. Of that advertising revenue, 84% (just coincidentally) came from Google properties.

As an investor, this is positive because it’s harder for Amazon and others to compete with Google on its own properties. As long as users continue to visit Google.com and use YouTube, Google will continue to be able to generate significant revenue from them. That said, I expect revenue growth from Google properties will continue to slow for two reasons –

More people are going directly to Amazon to search for items when they have ‘commercial intent’ i.e. they want to make a purchase. This is going to direct more ad dollars away from Google to Amazon.

The price Google can charge advertisers will drop as advertisers have more options between Amazon and Facebook’s properties. Cost per click (CPC), which measures how much advertisers pay Google each time someone clicks on an ad, declined by 25% in 2018 and 7% in 2019 for Google’s properties.

The ad revenue from Google network members’ properties is expected to grow even more slowly because of the two reasons above and so I model growth of only 6% in 2021, slowing to 3% by 2024 and remaining at that level.

Google’s cloud business in 2019 generated only 6% of overall revenue. However, this is Google’s fastest growing business and I expect growth will continue at a high rate (post COVID) given the significant investments Google is making. I forecast the Cloud business will grow at 30% in 2021, with the growth rate slowing by ~5% every year till 2024. I then model the growth rate declining by 1-2% per year as the cloud business matures.

Google’s ‘other’ category is primarily made up of revenue from the Play store and subscription revenue from YouTube. This category has grown significantly in the last few years, but I expect the growth rate will slow dramatically by 2025 for two reasons –

Competition in YouTube’s subscription business will be fierce with Amazon and Netflix. Most consumers will choose from a subset of Netflix, Amazon Prime, Disney+, HULU, HBO and YouTube, and as of now YouTube subscriptions are nowhere near as popular as Netflix and Amazon Prime.

Google’s Android operating system is already the dominant phone OS with 74% market share in 2019. While the absolute number of Android phones globally will continue to grow, that growth rate will be slow. In addition, app developers are already complaining about the high fees Apple and Google are charging. With the companies concerned about being viewed as rent-seeking monopolies, there may be downward pressure on Play store revenue growth going forward.

Margins

Google’s margins have shrunk slowly in the last few years from 26% in 2015 to 21% in 2019. I expect margins will stabilize at about 20% going forward as the company focuses more on controlling costs and some of the long term bets begin to generate profits.

Valuation Results

Based on the revenue and margin assumptions above, as well as a terminal value of 20x FCFF and a 3% discount rate, my estimate is that Google stock is worth $1993 per share. This represents 11% upside to today’s stock price.

As always, my model is available here. Please feel free to tweak the assumptions as you see fit.

Upside Potential

Google has a number of ‘Other Bets’ at any given point of time. Its possible that over the next decades one of these other bets begins to make a meaningful contribution to revenue and income for Google. While I view this as highly unlikely, there are projects such as Waymo, which have the potential to become meaningful businesses. Given Google’s historical performance with these other bets, I wouldn’t bet on it.

Online advertising in 2019 was ~50% of total ad spending. This is up from 46% in 2018. It’s possible that online continues to gain share at this rate and that by 2023, it represents 70% of all ad spending. My sense is that once online ads get to about 60% of the total market, the growth rate will slow, but I could be wrong. If the growth rate is higher than expected and Google’s share of online ad dollars stays about the same, this would result in higher revenues for the company.

Downside Risks

The biggest threats to Google’s ad business today are from Amazon and Facebook. Amazon has built its own ad platform and advertisers could choose to spend more promoting their products directly on Amazon.com versus advertising on Google. Instagram seems to be in the early stages of building out its shopping experience. Given the amount of time consumers spend on Instagram each day, the platform could attract ad dollars away from Google as brands seek to establish a bigger presence on Instagram.

Disclosure: I am long GOOG