Nike

A Cautionary Tale

First - disclaimer

TLDR

I expect Nike’s stock to compound at 8-12% a year over the next 5 years

The Setup

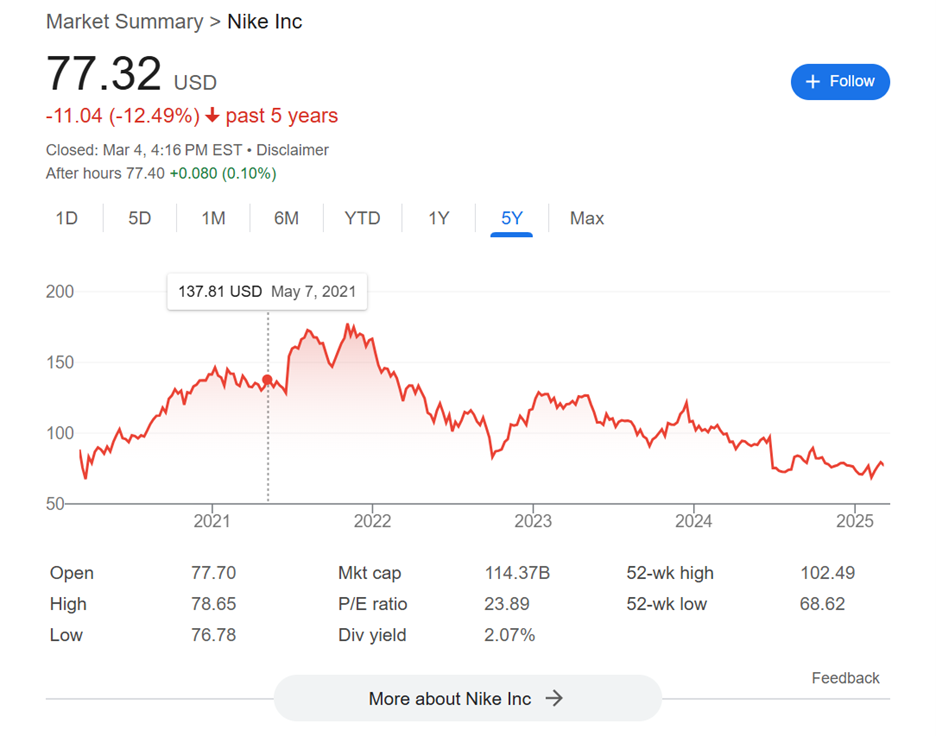

Here is Nike’s five-year stock chart –

This is one of the best illustrations of why the price you pay when you buy a business matters.

Five years ago, Nike could do no wrong. Revenue growth was a steady 6 to 7% from 2016 to 2019. Operating margins were steady. And investors were willing to pay 40 times free cash flow at the beginning of 2020 for a company that was growing earnings at about 5% a year. You could argue this was insanity, but we’re seeing similar insanity with companies like Walmart and Sherwin-Williams today.

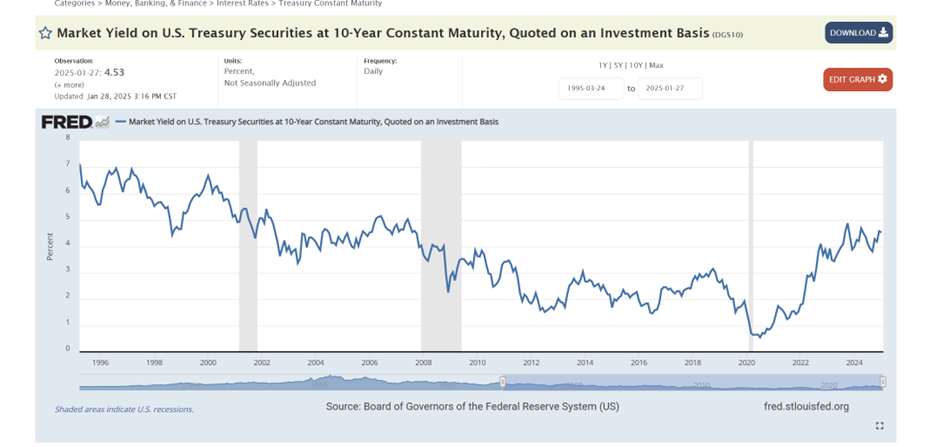

The difference between five years ago and today is that interest rates have moved up sharply and as Warren Buffet has famously said "Interest rates are to asset prices what gravity is to the apple".

In a world of 2% T bond rates, I can somewhat understand paying 40x earnings with the expectation that earnings will grow and you’re getting a 2.5% return in the form of buybacks and dividends. In today’s world, where you can make 5% without taking any risk, paying 40x earnings for a business growing earnings at 5% makes no sense to me.

To buy any stock today, I’d want to compound at 10% a year in my base case, with very low downside risk. Ideally, you’d want to find investments where you expect to earn at least 15% a year over the next five years.

Five years ago, Nike investors were not wrong about revenue growth continuing (it’s grown at 5% a year on average since then) and margins staying about the same. The problem is the multiple on earnings has fallen from 40x to 22x, so you’ve lost money over five years, while the S&P 500 has almost doubled in the same time period.

Here is the question for today - is Nike a good investment at 22x trailing earnings?

Like other businesses we’ve looked at in the past, it comes down to two primary metrics. Revenue growth and operating margins. Let’s start with the former.

Revenue Growth

In the first half of fiscal 2025 Nike’s revenue is down 9% YoY. This seems like the kitchen sink year where the new CEO is purging inventory and setting up the business for long term growth.

The focus going forward is going to be on sports and going back to Nike’s roots of creating great products for athletes. I could see this working and so I model revenue growing about 5% a year starting next year. This is back to pre-COVID levels of growth.

I don’t think this growth will come easily given the competition from HOKA, ON Running, Adidas, New Balance and Lululemon (in apparel), but it doesn’t seem like a crazy stretch.

Feel free to use your own assumptions in the model here.

Operating Margins

From 2015-2017, Nike’s operating margins were 14%. For fiscal 2024 they were 12%. From the last earnings call, it sounds like there was quite a bit of discounting on Nike’s direct sales channels. As the products and inventory management get better, I’m inclined to believe margins will improve too, so I’m modeling a 15% operating margin in 2030. To provide some context, Deckers (which owns HOKA and UGG) has 20% operating margins. ON Running which only does a little over $1B in revenue has 15% operating margins.

Valuation

With the above assumptions, Nike will earn about $7.5B in net income (NI) in 2030. I expect NI will equal free cash flow as it has for the last few years, so I think this is the right number for shareholders to focus on. I struggle to assign more than a 20x multiple to this. Deckers trades at less than 20x today and is growing 10% a year. Retail is a hard business and consumer preferences can turn on a dime.

A 20x multiple gets us to a market cap of $150B, which is 5% a year in annualized upside. You could argue for a higher multiple given the stickiness of the brand. A 22x would give you 7% a year in gains.

It’s important to remember that Nike has a long history of buying back shares and paying a dividend. They’ve consistently returned about $5B a year to shareholders since 2018. Assuming this continues, that’s about a 4% yield at the current share price.

Adding the stock price appreciation to the shareholder yield gets you about 10% a year for the next five years.

In today’s environment where you can make 7% in a relatively risk free structured credit ETF like JBBB, this certainly doesn't seem that compelling.

I’m going to buy a small position to follow the company and add more if the investment proposition gets more compelling.

Risks

1. About 60% of Nike’s revenue is international. The recent strength of the US dollar is going to be a headwind to revenue in the short term

2. Tariffs. This has been the topic du jour for the last week and it’s anyone’s guess how things will actually play out. As you can see below, Nike’s manufacturing exposure to China is not very high, but if similar tariffs were to be imposed on Vietnam, that could be a drag on margins.

For fiscal 2024, factories in Vietnam, Indonesia and China manufactured approximately 50%, 27% and 18% of total NIKE Brand footwear, respectively.

For fiscal 2024, factories in Vietnam, China and Cambodia manufactured approximately 28%, 16% and 15% 2024 FORM 10-K 3 of total NIKE Brand apparel, respectively.