Peloton - Priced to Perfection

Price Target: $85 (Base Case) & $130 (Bull Case)

Peloton stock is up more than 5x since its IPO one year ago. The CEO, John Foley, has great ambitions for the company and COVID has dramatically accelerated the company’s growth trajectory. The question investors now need to ask - is future upside already priced in or is Peloton stock still a good investment today?

TLDR – it all depends on how many subscribers you think the company will add in the coming years. The market seems to believe the number of subscribers will increase 6x in the next four years.

I think this is optimistic, but please keep reading for more context. I’d love to hear whether you think the market is underestimating or overestimating subscriber numbers and what your best guess is for the number of Peloton hardware subscribers in 2024.

Business Model

Peloton is known for their sleek hardware, but they are banking on their subscription business for long term revenue growth and profitability. There are two offerings – the Connected Fitness Subscription (for which you need a Peloton device) and the Peloton Digital Subscription (an app that anyone can use). The Connected Fitness Subscription (CFS) is priced at $40/month and can be used by anyone in the household. With this subscription, you can join live classes and the device transmits your performance, so you can compare yourself to others in the class. The Peloton Digital app is priced at $13/month and gives you access to all the classes Peloton offers, but there’s no integration with the hardware.

Based on the most recent earnings numbers, there appear to be 1.3mm Connected Fitness subscribers and 0.5mm Digital subscribers. Peloton’s valuation depends almost entirely on how many subscribers they can continue to add in the coming years.

Subscriber Growth Assumptions

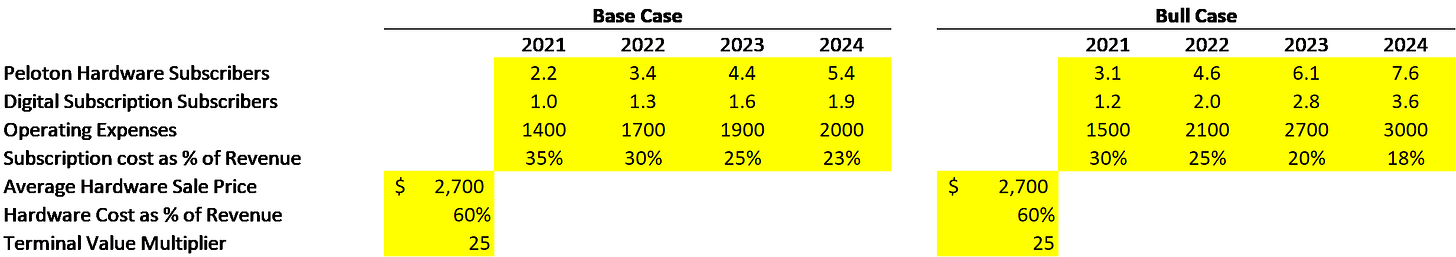

It’s still early days for Peloton, so I look at two scenarios in this analysis – the base case and the bull case. Below are assumptions for each of them.

Base Case

My sense is that competition for the Digital app will be strong. Netflix or Amazon could begin producing fitness content and make it available to subscribers at no added cost. There are individuals with online classes like Melissa Wood, who have a significant base of subscribers. Essentially, any knowledgeable and charismatic instructor could produce content or be hired to do so. Given COVID has already driven a large part of the fitness market online, I believe the number of Peloton Digital subscribers will increase about 4x to 1.9mm in 3 years.

Connected, in-home fitness, as a category, is clearly going to grow and I expect there will be plenty of new competitors over the coming years. John Foley thinks big box gyms are going the way of video game arcades from the 90s, and it’s hard to disagree. Peloton has the benefit of not only being early to the party and creating a premium brand, but they also have had the incredible at-home-gym-accelerator that is COVID. I expect strong growth (~1mm new connected members / year) to continue for the next few years as word of mouth on how good the product is spreads. I therefore forecast 5.4mm Peloton device subscribers by 2024 vs 1.3mm today.

Bull Case

Listening to interviews with John Foley, I get the sense that he wants Peloton to be the Netflix of wellness. In the scenario where Peloton offers every possible kind of workout, along with wellness content around diet, lifestyle and mindfulness, it’s possible that signups for the Digital app explode. In this scenario there could be almost 4mm subscribers in four years. This doesn’t seem unreasonable given Hulu has 30mm subscribers and HBO Now has about 8mm. These are both somewhat niche services compared to Netflix and Amazon.

Peloton could also choose to lower prices on the hardware to get their devices into as many homes as possible. In this scenario, margins on hardware would shrink, but this would be offset by significantly more users. I forecast 7.6mm households with Peloton hardware subscriptions in 2024 in this bull case, vs 5.4mm in the base case. Peloton recently announced a price drop on their bike and introduced a cheaper treadmill, so it’s clear they are focused on getting Peloton hardware (and by association, content subscriptions) into more homes.

Margins

I expect the cost of subscriptions (as a percentage of subscription revenue) to improve from ~43% today to 22.5% in the base case and 17.5% in the bull case by 2024. This is simply because the amount of content doesn’t need to scale in proportion to the subscriber base. Content costs could be even lower, but I suspect Peloton will need to pay celebrity instructors top dollar to retain them. If others like Amazon and Netflix enter the market, you could imagine a wellness content war where content creators command very high premiums. In addition, Peloton will probably feel the need to offer a slew of live classes at different times of the day to keep their members engaged.

Operating costs have grown dramatically over the last couple of years and represent about half of Peloton’s revenue in 2020. While, I don’t expect these costs to grow at the same pace as revenue, Peloton will likely continue to spend heavily on sales and marketing as well as headcount growth. I therefore assume these costs to represent about 40% of revenue by 2024 and stay at about that level in both the base case and bull case.

Terminal Value

Given how new the company is, it’s difficult to forecast what happens more than four years out. Assuming slower growth beyond year four, I use the 2024 numbers to compute terminal value. Note that I ignore depreciation and amortization as well as capital expenditure, because I feel these will net out in the long run. I therefore equate FCF to Net Income and use a multiple of this number to value the firm. I use 25x FCF for both the base case and bull case.

Valuation

Based on these assumptions, I compute a per share value of $85 for Peloton stock in the base case and $130 in the bull case. This is a big range and represents the difficulty of accurately valuing a young company. Given the current price of $140, I would not buy the stock unless you’re a big believer in the bull case. If the stock gets down to $85, I’ll be a buyer.

The model has a dropdown to choose between the base case and bull case. The assumptions for each of these cases is on the first tab and are shown below. Feel free to tweak these as you see fit.

Notes

A few interesting data points which may be helpful to form a view on Peloton hardware sales going forward and therefore the number of connected fitness subscribers.

1. In Q3 2019, 32% of Peloton subscribers also made a payment to Affirm. This means one-third of buyers may not comfortably be able to afford the hardware. The fact that they are still buying a Peloton makes me think households in America earning over $120k/year could be potential Peloton customers. There are ~23mm such households in the U.S.

2. There are about 60mm Americans with gym memberships that spend $50/month on average. Assuming about 20mm of these individuals are married, that represents 40mm households in the U.S. that could be potential Peloton customers.

3. Netflix has more subscribers internationally than in the U.S. and on average they pay only about 30% less than Americans per month. This makes me think that if Peloton can sell into about 8mm households in the U.S, there’s no reason they can’t get to another 8mm households outside the U.S. This expansion would be primarily in Europe, Australia and Canada initially.