Worth Watching

Pinterest announced great results this month and the stock jumped 20% the next day. It would obviously have been better to take a deeper look at this business six months ago, but better late than never.

Background

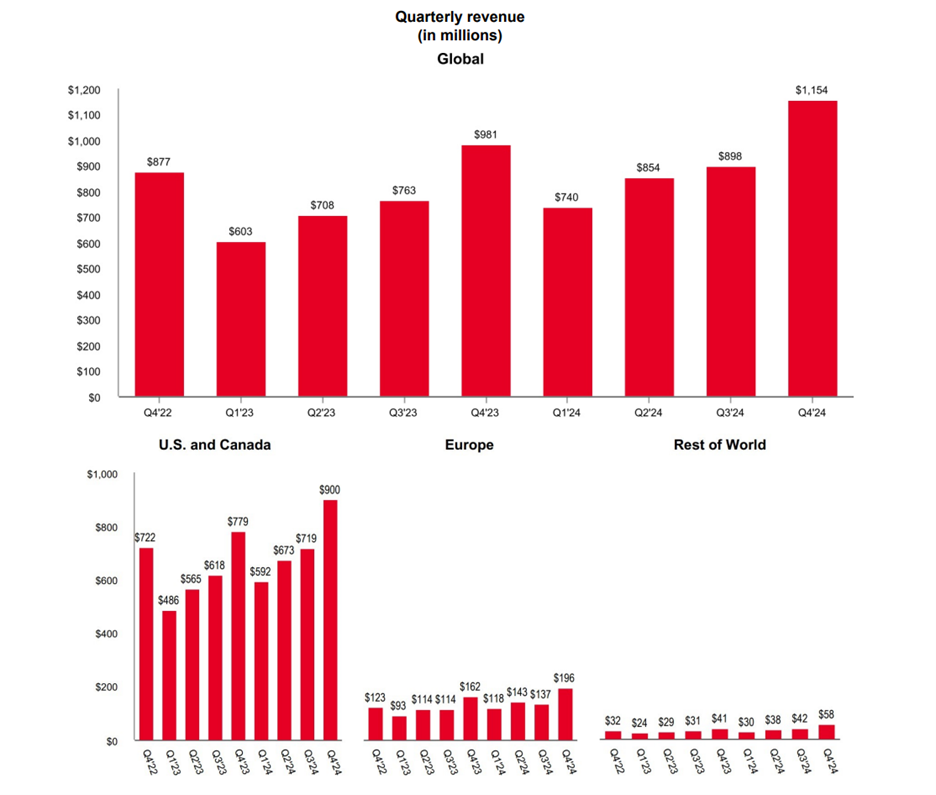

Pinterest was founded in 2011 and went public in 2019. Revenue grew over 50% a year in both 2020 and 2021 and the stock peaked at $85 (about a $50B market cap) before collapsing to $19 a year later as revenue growth slowed to 8%. In the most recent quarter, revenue growth accelerated to 18% and the company had a lot of positive things to say about how AI is going to drive sustainable growth going forward. If you believe revenue will grow at 15% a year over the next five years, there’s a good chance the stock doubles in that period.

Here's what Pinterest does – from their most recent 10k.

Pinterest is a visual search and discovery platform, positioned at the intersection of search, social, and commerce. We offer a unique and differentiated experience that enables people to go from inspiration to action all on one consumer internet property. Pinterest can be accessed through our mobile application or the web.

People use Pinterest to find useful, relevant ideas—and then bring them to life. People don’t always have the words to describe what they’re looking for, but often know it when they see it. As they browse Pinterest content (called “Pins”), they fine-tune their tastes and find the perfect idea. Users interact with the platform in dynamic multi-session journeys to find inspiration, curate their latest look, plan their next project and shop from great brands. This happens at a massive scale, with billions of searches and saves per month.

The unique, first party, intent-based signal we receive from user actions on Pinterest helps power the AI based recommendation systems that we use to surface relevant and engaging content to our users.

AI also plays a central role in how we drive value for our advertisers, who come to Pinterest to reach our users with high commercial intent. The inspiration-to-action journey on Pinterest aligns with the advertiser marketing funnel, allowing us to help brands reach customers at every stage, from discovery to purchase, through digital ads.

We believe users and advertisers intentionally choose Pinterest because of our efforts to create a positive and more brand safe environment. As a result, we make deliberate decisions through our policies and product development and aim to deliver on that experience, creating value for advertisers who can showcase their product and services in an inspiring and positive environment.

Analysis

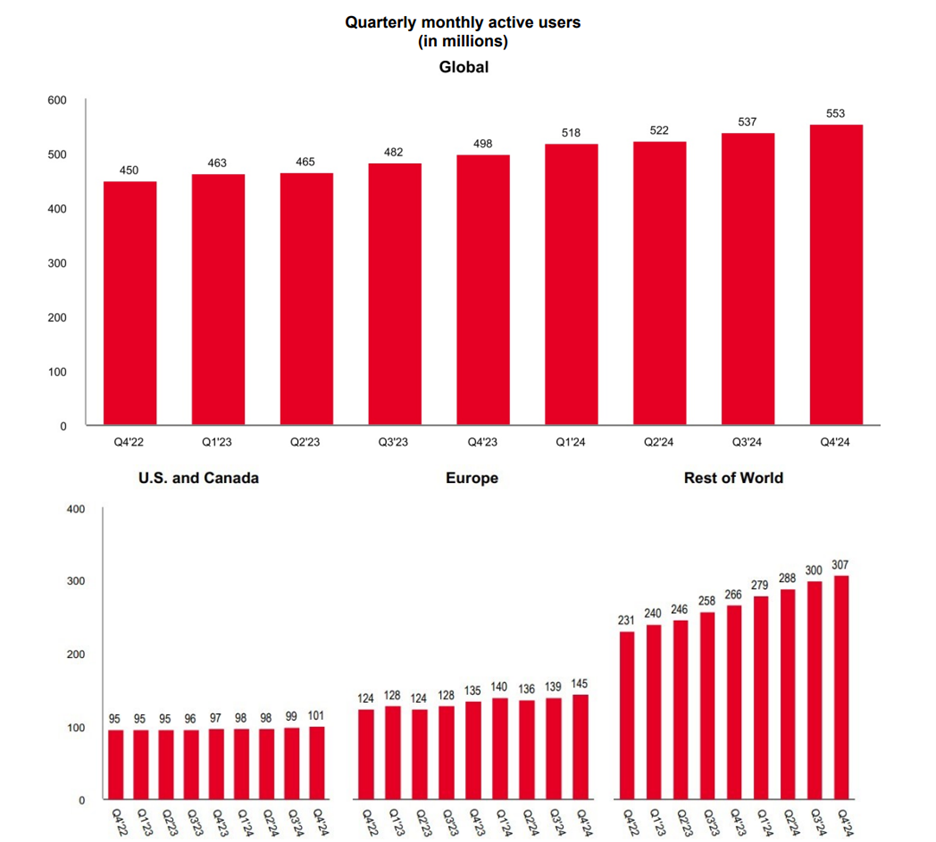

Like any platform, the number of active users is critical. But users that translate into ad revenue matter more. As you can see below, Pinterest appears to be quite saturated in the US and Canada.

Unfortunately, the US and Canada provide about 80% of Pinterest’s revenue.

A bullish argument here would be that over time Pinterest will get as much revenue from the rest of the world as they do from the US and Canada today. This alone would essentially double their revenue. This is certainly possible and is an area of focus for them.

Revenue Growth

I model revenue growth declining from 15% in 2025 to 10% in 2029. In 2024, which was a banner year for internet advertising businesses, they added 0.5B in revenue. It’s hard for me to see them adding meaningfully more than that going forward. This is a fiercely competitive space and only getting more so. Feel free to include your own assumptions in the model here.

Operating Expenses and Multiple

Pinterest, like many other tech companies, has shown remarkable cost discipline over the last couple of years. Despite this, they barely eked out a 3% operating profit in 2024. Assuming the focus on costs continues, it’s not inconceivable that in five years their EBIT margin is 25% and they’re making 1.4B in net income and a similar amount of FCF.

It’s anyone’s guess how fast Pinterest will be growing in five years from now, so I don’t feel comfortable assigning more than a 25x multiple to net income.

In this scenario, the company will be worth $35B vs the $27B today. That’s only 27% in upside, so I’m going to take a small position here and wait to see how things evolve.

Risks

1. The biggest risk to me is that Google could just create Pinterest by adding a ‘pin it’ option to their image search page. Unlike Meta, there seems to be no content created for Pinterest. They just pull it in from various parts of the internet, so its hard to see what makes them so uniquely valuable.

2. From using the platform over the last couple of days, it feels very saturated with ads, so its unclear they have meaningful room to grow ad impressions unless engagement improves.

Positives

1. Insider sales have been very small over the last year ($22m in total sales) - https://www.dataroma.com/m/ins/ins.php?t=y&&sym=PINS&o=fd&d=d

2. They could be included in the S&P 500 in a couple of years if profitability endures and they keep growing

3. It may turn out Pinterest is early in their monetization journey and revenue growth keeps accelerating from there. Like Google, in the last couple of years, the growth may come from a combination of increased impressions and higher price per impression. There is a world in which each of these grow 10% a year on average leading to 20% annual revenue growth for the next five years. Two thirds of their users are women, which is unlike any other large social media platform, so this could be a uniquely attractive place for advertisers.

Here’s what Bill Ready (the CEO) had to say on this topic on the latest earnings –

First, is continuing to grow our user base and deepen engagement, and bring back users more frequently through our efforts in actionability and curation. As we stated many times, relevant ads can be great content for our users and additive to the user experience, particularly when they're in commercial context. And as such, we see room to further grow our ad load, particularly in high-intent surfaces and verticals on our platform, and for those users that, again, are in a commercial mindset. Secondly, we'll continue to drive improved performance for advertisers through lower funnel product innovation and ad platform efficiencies. Performance+, which we just rolled out late last year, will continue to be enhanced through features like ROAS bidding and Performance+ creative. As I've always said, we expect Performance+ to be a steady build with a multi-year product and adoption cycle. No hockey stick in growth in one particular quarter, but a steady build over a multi-year product and adoption cycle. And finally, we'll continue to complement our strong and growing first-party business through new sources of demand as you've seen us do through the launch of resellers and third-party partners. And we'll continue to optimize and test with incremental sources of demand over time.