Salesforce: Shareholders Best Days Maybe Behind Them

Price Target: $177

Marc Benioff, the CEO and co-founder of Salesforce is big on stake holder capitalism. Not only does he want his shareholders to benefit from Salesforce, he also wants employees, customers, the planet, and the communities in which the company operates, to prosper. So far shareholders have been massive beneficiaries of Benioff’s unique approach to business, with the stock up 3x in the last five years.

I’m personally a fan of Benioff’s stake holder capitalism model and I wish more CEOs would adopt it. That said, from a stock standpoint, I think Salesforce (ticker: CRM) may have gotten a little ahead of itself. Based on the analysis below, I believe the stock is worth about $177 (17% less than the current price), so I’ll be waiting till the price gets to the $165 range before I add it to my portfolio. There’s obviously a good chance it never gets that low, but I’m ok not owning it if that’s the case.

Revenue Growth

CRM has averaged revenue growth of 26% over the last five years, and guidance for fiscal 2022 suggests growth of ~21%. This would imply $5B in additional revenue in 2021. I expect growth to continue at this rate for the next few years before slowing down slightly to result in $50B in revenue in fiscal 2026 (in-line with the company’s projections from management). I expect revenue growth to slow beyond 2026, but still model $6-7B in growth each year. If history is any guide, a significant portion of this growth will come from acquisitions.

Margins

This is where Salesforce diverges significantly from its peers. In fiscal 2021, CRM’s operating margin was 2%. This is dramatically lower than Oracle and Microsoft which have operating margins in the 30-40% range, depending on the business. There’s a narrative in the market where Salesforce is compared to Amazon (another business which has had very low operating margins over the last decade).

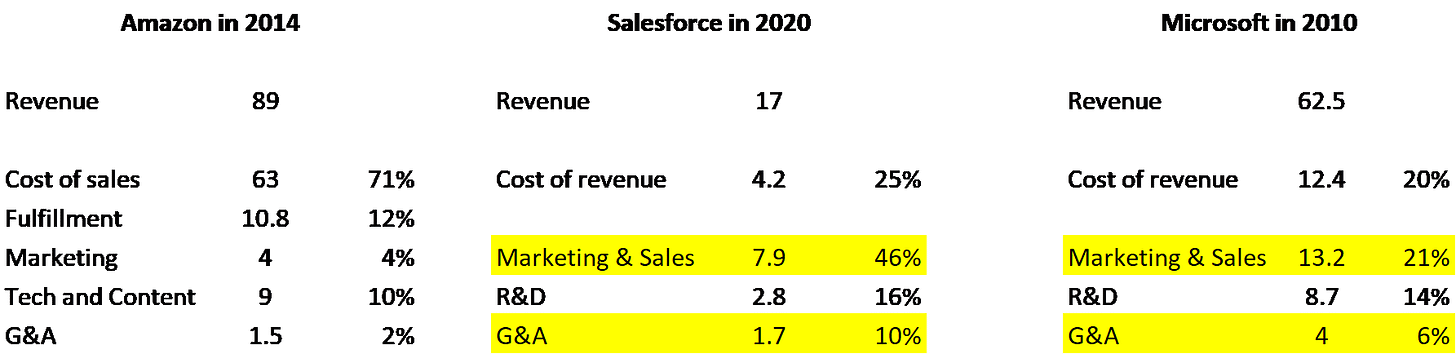

I think the comparison with Amazon is flawed because, until recently, Amazon was fundamentally a retailer, while Salesforce is in the software business. As you can see in the table below, the reason Salesforce has such low margins, is because their Sales and Marketing, and General and Administrative (G&A) costs are much higher than Microsoft (and Amazon). The reason I use Microsoft and Amazon numbers from the past is because at those points in time, Microsoft and Amazon had market caps that were in the same range as Salesforce today.

In assigning CRM a $195B market cap today, the market seems to believe margins will improve over the next decade from 2% today to approximately 13% by 2030.

While this is certainly possible, my view is that margins will be closer to 10%. Once a company establishes a culture where people are paid a certain way it’s difficult to change. This is especially true for sales people that have visibility into exactly how much revenue they bring in and are compensated based on it. I could be wrong, and the difference between 10% and 13% is not huge, but looking at the business today I’d take the under on 10%. If Salesforce brings their Marketing and Sales costs down to levels closer to Microsoft, margins could easily be 20% and the stock would be worth closer to $300.

Feel free to put your own assumptions into the model here.

Management

Salesforce has three large competitors – Oracle (where Benioff worked for a decade before starting Salesforce), SAP and Microsoft. None of these companies are going to be easy to win share from, which also makes me skeptical on margin improvement. That said, I’d bet on Benioff over Catz (Oracle’s current CEO and a former banker) to make the right long term decisions for their respective companies.

Valuation

Based on the above assumptions, a terminal value of 25x FCF, and a 4% discount rate, I arrive at a per share value of $177. Note that I assume the Slack acquisition will be completed later this year, so I reduce cash and increase shares outstanding and debt to pay for the acquisition.

I believe 4% is the right discount rate for two reasons –

1. It’s in line with CRM’s long term borrowing costs (they have 2028 notes outstanding at 3.7%).

2. Shares outstanding have increased over 20% in the last two years, primarily because of the Tableau acquisition. They will increase another 5% if the Slack acquisition is completed. I expect Salesforce to continue to make acquisitions in the next decade financed primarily by its equity, so I think investors need to factor in the price of this equity. My sense is generic stock market returns will be 4-5% (including dividends) over the next decade, so using 4% for the cost of capital seems reasonable.

I really want to be a shareholder in CRM. Here’s hoping the market provides an attractive entry point.