Tesla – What Do You Believe?

Price Target: $290

If you’re thinking of buying shares in Tesla, or already own some, there are only two things you need to have a view on –

1. Electric car sales over the next 10 years

2. Tesla’s Operating (EBIT) margins

Expectations for electric car sales in 2030 diverge wildly. The most credible estimate I’ve seen is from the IEA. They forecast 70mm electric cars being added in the next 10 years if governmental policies remains as is. If policies change to become compatible with the goals of the Paris Agreement, they forecast 135mm electric cars being added in the next 10 years. Note these numbers reflect cars that operate purely on batteries. They also predict substantial growth in plug-in hybrid cars, but since Tesla only sells battery powered cars, we’ll ignore that category for now.

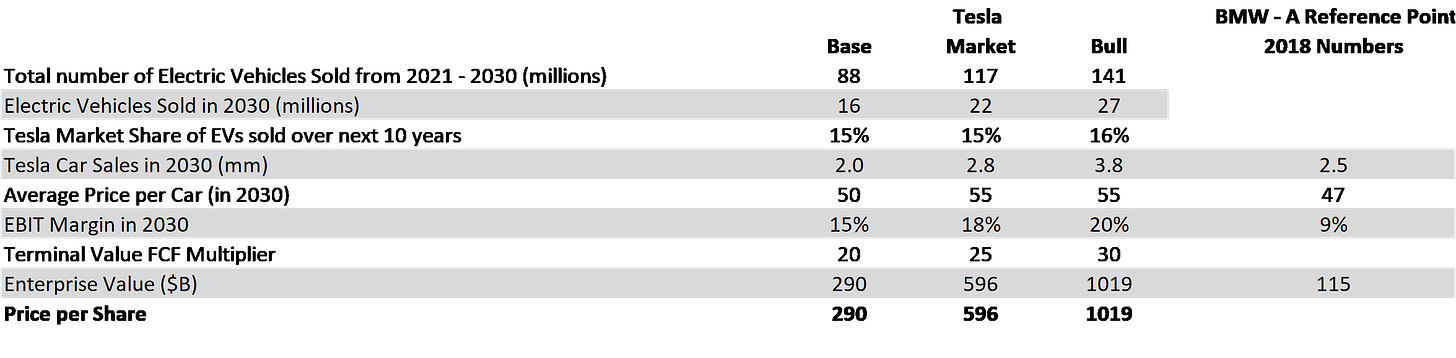

Below are three different scenario’s I’ve modeled for Tesla. The ‘Base’ case reflects my best guess for electric car sales over the next ten years and Tesla’s margins. The ‘Market’ scenario lays out what sales and margins would need to be to justify todays share price. The ‘Bull’ case reflects a world where battery technology and charging infrastructure improve dramatically, such that almost 50% of all cars sold in the US, EU, and China in 2030 are purely electric. The table below shows the share price for Tesla in each of these scenarios. I’ve also included BMW’s numbers from 2018 as a guide. As you can see, depending on what you believe, Tesla is either overvalued, fairly priced, or undervalued.

Let’s dig into some of the assumptions in more detail.

Tesla’s EV Market Share

You’ll notice in the table above that Tesla’s market share is not that different in each of the scenarios. The reason for this is that the biggest car manufacturers in the world today (Toyota and VW) have about 14% of the market. They also sell cars at an average price under $30k. Tesla has an average sale price of $60k today, and I never model this going below $50k. This average sale price is closer to manufacturers such as BMW ($47k in 2018), which has 3% market share. While I appreciate that Tesla has a head start on electric vehicles, a market share above ~15% seems very difficult to justify. In the bull scenario, Tesla would effectively be selling as many cars in 2030 as Honda sells today. The big difference is that Honda’s average sale price is $27k, whereas I model $55k for Tesla in 2030 (more than double). This seems plenty bullish to me!

The most likely scenario to me is that Tesla is selling about 2mm cars in 2030 (about 20% less than BMW today) at a price of $50k per car (this is in line with BMW).

Operating Margins

Tesla’s 2020 operating margins are expected to be about 8%. This is about the same as BMW’s margins over the last few years and a huge improvement from the 1% margins in 2019. Note that the bulk of the operating margins come from the sale of zero emission regulatory credits to other OEMs, so 8% in 2020 is not a true operating margin.

Common wisdom is that margins will improve with scale, and I agree. The question is how good do they get? My base case assumption is they get to about 15%, which is 50% better than BMW’s margins. This seems reasonable given Tesla focuses exclusively on electric power trains and the fact that battery costs have been consistently declining over the last 15 years.

The 20% margins I model in the bull scenario seem like a stretch, but are maybe justifiable given Tesla’s focus on software and the ability to sell existing car owners software ‘upgrades’ to improve the performance of their cars. Tesla also captures margins that traditional manufacturers give up to dealers.

Terminal Value Multiplier

In my model, I assume Free Cash Flow (FCF) to Tesla’s shareholders equals net income in 2030. Looking at car companies today, the ratio of their enterprise value to net income ranges from 17 (for VW Group) to 28 for BMW. I therefore use a range of terminal value multipliers in my model (20 for the base case, 25 for the market and 30 for the bull case).

Valuation

Note that for the purposes of this valuation I ignore any business lines Tesla may enter going forward. I also largely ignore the energy business from an analysis stand point and assume it will grow in line with the car business and have similar margins. This is obviously a gross simplification, but given the uncertainty of just valuing Tesla’s car business, this felt like the right choice. Tesla’s energy business is likely to be less than 15% of revenue in 2020.

If you’d like to use your own assumptions, I’d suggest using the ‘Base’ tab in the model and putting in the assumptions you think are reasonable. The model is here.

While I believe the stock is currently overvalued, sentiment and momentum are powerful forces, so its entirely possible the stock reaches $1000 over the next few months (especially with its inclusion in the S&P later this month). I have no position and don’t expect to initiate one on either the long or short side at this time.

Notes

In the large, established car markets of the US, EU and China, my guess is that plug-in hybrids will be 50% of car sales in ten years, purely electric vehicles 30% and gas vehicles 20%. Fifty-five million cars were sold in these markets in 2019 and given the slow growth rates over the last few years, I expect the number will get to sixty million in 2030 (mostly thanks to China). 30% of 60mm represents 18mm electric cars sold in 2030, which aligns most closely with my base case. I don’t expect markets like India and Africa will be large for electric cars till 15-20 years from now given the high cost of these cars (50k and above as modeled for Tesla) will put them out of reach of most buyers in these markets.

The model could have been built better with an assumptions tab feeding into the different scenarios, but I wanted to get this post out quickly given the interest in Tesla stock at the moment, so my apologies. I’ll refactor the model later.