HIMS

Is the Growth Real?

Introduction

If you’ve been on social media or watched any sort of video content with ads over the last couple of years, you’ve probably come across Hims and Hers (ticker: HIMS). The company spends over half a billion dollars a year on slick ads trying to convince users to buy pills to treat everything from hair loss to erectile dysfunction (ED). They’ll even customize a pill to treat both if you need it :).

The company specializes in conditions that have a stigma associated with them, such as erectile dysfunction or mental health, which makes users more likely to search for a cure online. They also primarily focus on areas where consumers will be on the medication for many years or potentially for the rest of their lives.

There are essentially three components to the HIMS business:

1. A tech platform that brings in new users and maintains their records

2. An “Affiliated Medical Group” with medical providers that only work on the HIMS platform

3. An “Affiliated Pharmacies” group that dispenses pills only for HIMS users

Most states prohibit corporate entities from owning medical groups, so the HIMS medical group and pharmacies are set up at VIEs. Here are some additional details on this creative legal structure. There are potential risks with this setup, but let’s ignore those for now and delve into whether this is a good business and potentially worth investing in.

The Business

Revenue growth at HIMS has been nothing short of spectacular. After launching in 2017, they were at $83M in revenue by 2019. Five years later, they’re on track to do $1.5B. Revenue is currently growing 70% YoY. See this spreadsheet for select historical financials.

This growth is powered by spending on social media and TV / YouTube ads. The company has historically spent about 50% of revenue on advertising.

Unfortunately, the incremental cost to acquire a customer (CAC) has gone from $544 in 2021 to $929 today (rough math). The annual revenue per customer has increased from $495 to $668 in the same period. It’s possible that customer revenue will catch up to CAC over time as their advertising algorithm optimizes around targeting the customers with the best long-term prospects for the company, but the current trend of CAC increasing faster than revenue per customer is not a good one.

Yesterday, Amazon announced that they are entering the verticals HIMS plays in with a similar offering. Low price generics for conditions like hair loss and ED. See blog post here. Usurpingly, HIMS stock promptly dropped 25% on the news.

Bezos is famously known to have said “Your margin is my opportunity”. In the case of HIMS which is currently a break even business with a target adjusted EBITDA margin of 20% in 2023, Amazon’s entry could be a death knell.

So how could HIMS compete against amazon?

Could they offer a superior product? Unlikely since they essentially just sell generic drugs in different formulations.

Could they offer a superior customer experience? Possibly. I compared One Medical to HIMS for hair loss treatment on Wednesday and while the HIMS platform felt more intuitive, I didn’t want to go through the hassle of signing up with them. I didn’t have to do this with One Medical because I’m already a subscriber, so they have all my information. This easy sign up experience will now be available to all 180m PRIME members in the US for all the big categories HIMS is in.

A Possible Outcome

Lets assume, there’s enough room for multiple players and HIMs grows their subscriber base from 2M today to 5M in five years. This seems reasonable given they added about a million new customers in the last 2 years. Assuming, average spending per customer increases by about 25% over time (from cross selling and better retention), HIMS will be doing about 5B in revenue in five years.

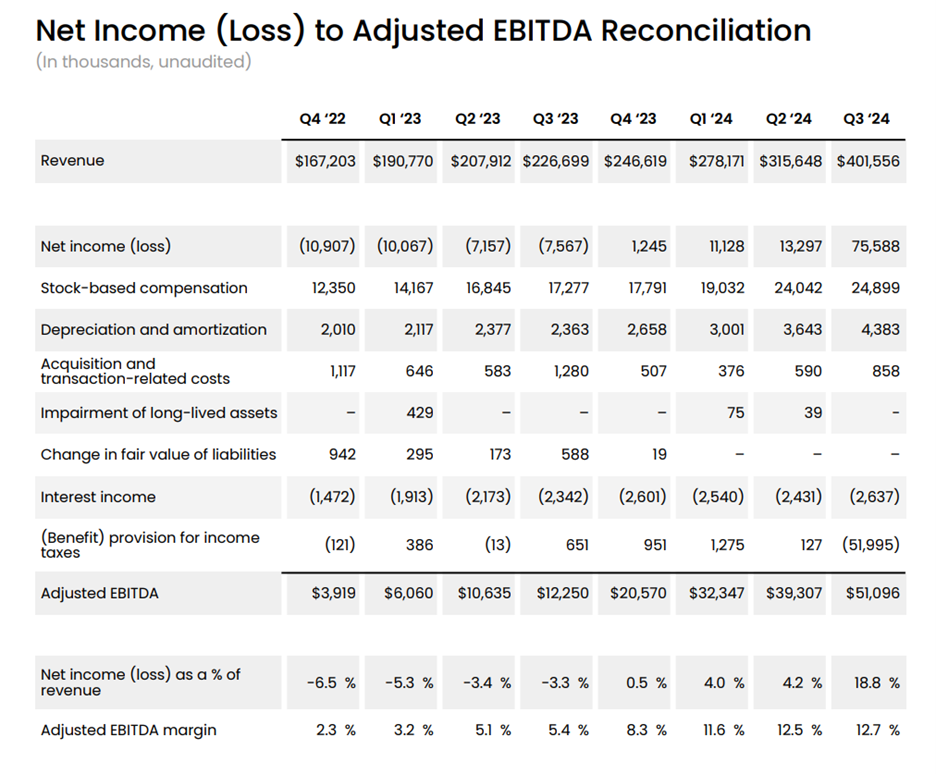

Management has said they’re targeting an ‘adjusted’ EBITDA margin of 20% by 2030. I don’t believe in adjusted numbers, so I’m going to haircut that by 6% for stock based compensation. This is about how much revenue has gone to stock based comp in the last few years, which is a very real expense. See below.

That brings us to a 14% EBITDA margin. Given they operate a physical pharmacy, the D&A costs are also real and cannot be ‘adjusted’ out, so that drops the margin further to 13%. After taxes (assuming the current 21% rate holds), they will end up with a 10% net income margin.

This means that in five years, HIMS will be earnings $500m in net income per year. If this scenario plays out, a 20x multiple on earnings seems easily justifiable and you end up with a company worth $10B in five years. Almost exactly double where the stock trades today.

My View

A lot has to go right for the above scenario to play out. HIMS has to more than double their current user base by providing a better customer experience than Amazon while only accepting direct payments from customers. One argument for why this can happen is that One Medical and the Amazon pharmacy are currently just small businesses inside a behemoth, whereas HIMS specializes in this space. If you believe this, HIMS is probably worth buying.

The issue I have, is that their competitive advantage seems to be in advertising and using social media to bring on users. I’m struggling to think of a business that has scaled and survived solely because of advertising. Advertising typically needs to work in conjunction with a differentiated product. In the case of HIMS they are selling generic drugs that are exactly the same as those you could get from Costco or Amazon. And these companies have a scale advantage which lets them provide the medicines more cheaply.

Researching HIMS for the last few days makes me more optimistic about Amazon. HIMS uses AWS for their tech stack, so Amazon wins even if HIMS beats them at the telehealth / pharmacy game.

Notes

Customer Retention

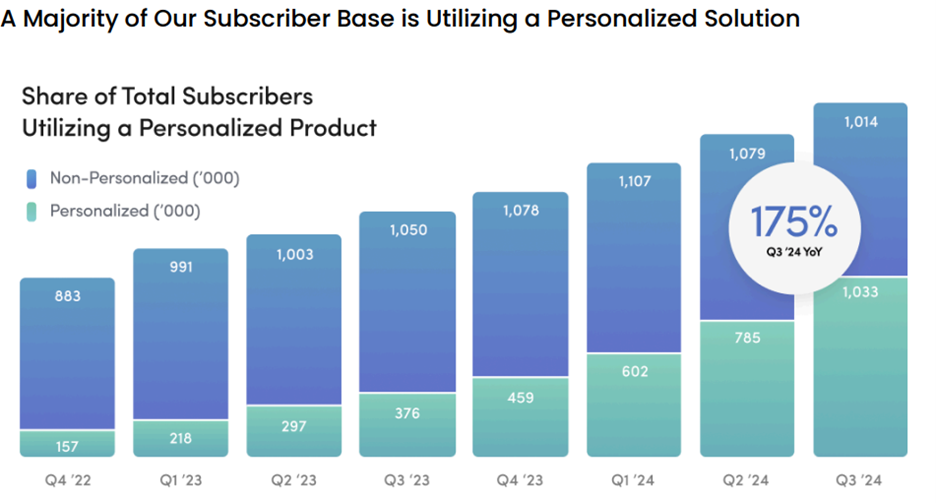

Per the latest shareholder letter 85% of customers have kept their HIMS subscriptions for at least two years, so this speaks to the stickiness of the product / platform. This may have to do with the fact that over half of the customers have a ‘personalized’ medication. Personalized health care is a big part of the HIMS investor pitch. However we don’t know what retention looks like three or four years out. It would be helpful to have this data to determine the lifetime customer value.

See below from the latest shareholder letter.

Our belief is the momentum we are seeing is the direct result of our ability to be at the forefront of a transformation across the healthcare industry, which is democratizing a level of care historically only accessible to a select few. Technology platforms have allowed consumers to get faster, more-in depth, and customized access to services across numerous industries. Our platform provides consumers with those same benefits within the healthcare space, and we are seeing them respond. Today, more than 2 million subscribers as of quarter end receive treatment on our platform across our five core specialties: Sexual Health, Men's and Women’s Dermatology, Mental Health, and Weight Loss. Subscriber growth remains strong, with total subscribers in the third quarter growing 44% year-over-year.

Future Growth Potential

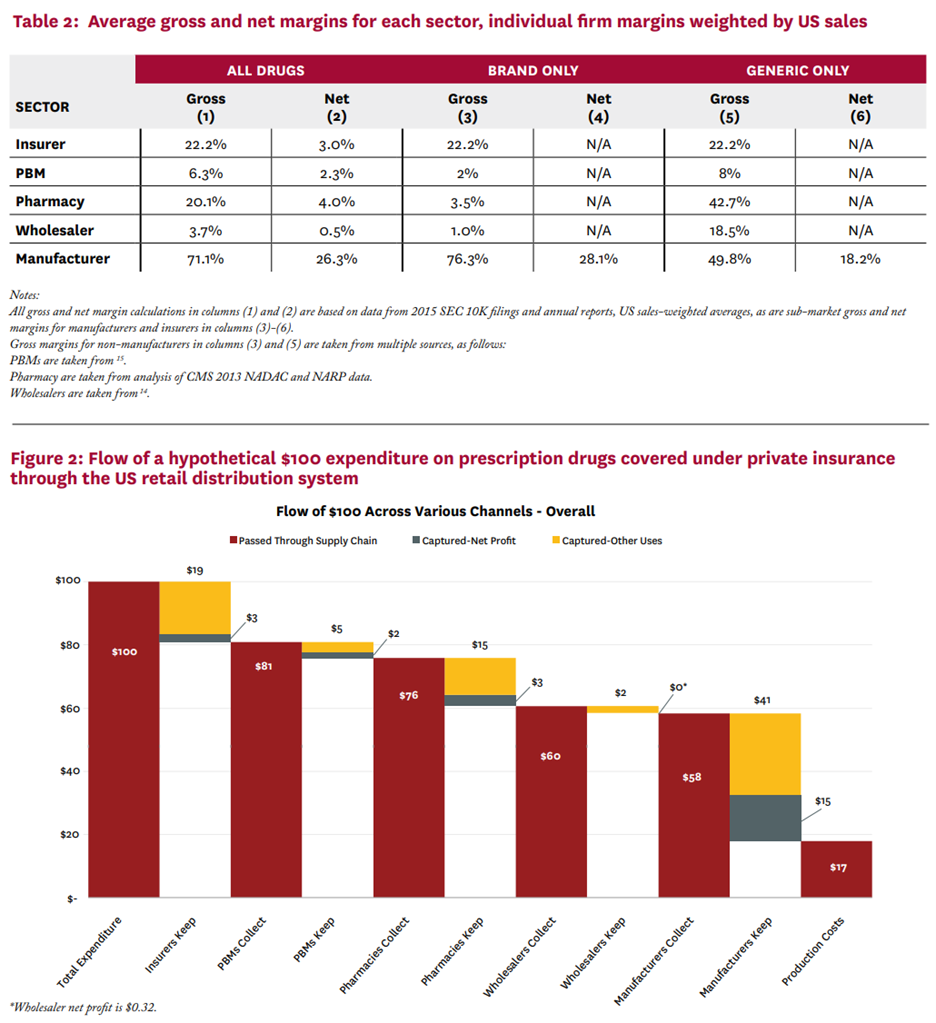

HIMS only accepts direct payment from customers. They do not accept insurance of any kind. They are set up this way because it limits the regulations they are subject to and they can capture margins that typically go to the insurer, PBM and wholesaler. See graphic below. Unfortunately, this could also limit their growth because over 90% of Americans have some sort of insurance and would likely want to use it to cover the cost of medicine vs paying out of pocket with HIMS.

Risks with Legal Structure

I’m assuming HIMS has structured their contracts with the ‘Affiliated Medical Groups’ and ‘Affiliated Pharmacies’ in a way that’s compliant with the current laws, but any change to these laws could completely upend their business model. See below from the latest annual report.

Despite our care in structuring arrangements with the Affiliated Medical Groups, it is possible that a regulatory authority or another party, including providers affiliated with Affiliated Medical Groups, could assert that we (or other organizations with similar business models) are engaged in the corporate practice of medicine or that the contractual arrangements with Affiliated Medical Groups violate a state’s fee-splitting prohibition. Failure to comply with these state laws could lead to materially adverse consequences for the Company

Given our current operations, the Anti-Kickback Law, the federal False Claims Act, the Stark Law, and other laws that are tied to federal health care programs or commercial insurer reimbursement should not apply to our business. If the scope of these laws is extended to include a broader spectrum of activities or if we begin to accept reimbursement payments from insurance providers or other third-party payors such as a government program, we could become subject to these laws and need to modify our business model. Additionally, should we begin accepting reimbursement payments from insurance providers or other thirdparty payors, the Company will be subject to significantly increased compliance obligations and costs.

Certain of the products available through our platform are compounded drug products under Section 503A of the Federal Food, Drug & Cosmetic Act (“FDCA”). While we believe the compounded drug products available through our platform meet the requirements for exemption under Section 503A of the FDCA, if the FDA were to determine that such products do not meet the requirements for exemption, the FDA could subject us, our Affiliated Pharmacies, Partner Pharmacies, Affiliated Medical Groups or Providers to regulatory and/or legal enforcement actions, including the issuance of a warning letter, injunction, seizure, civil fine, and criminal penalties. Other federal, state, or foreign enforcement authorities might also take action against us or the Affiliated Pharmacies, Partner Pharmacies, Affiliated Medical Groups or Providers if they determine that compounded drug products available through our platform do not meet applicable legal or regulatory requirements. Regulatory and/or legal enforcement actions by the FDA or other federal, state, or foreign enforcement authorities could have material adverse consequences on the Company and/or its operations.

Appendix Notes

1. They’re building their own electronic medical record (EMR) system. This could become a competitor to EPIC over time.

a. They are applying AI to all the data in the EMR to help doctors more quickly provide the right drug for an issue. This helps with patient retention.

2. 100m in oral weight loss ARR. Contrary to the media hype, GLP drugs are not a meaningful part of the HIMS business.

3. Payback period on customer acquisition is <1 year per the latest shareholder letter, but is computed using gross profit. This feels like nonsense given the operating costs. If you add in Ops and G&A it’s closer to 2 years.

4. Only 20% of customers are currently women

5. There’s a lot in the latest quarterly call and letter to make you skeptical on the general GLP1 hype

a. As most know, the actual coverage for the brand name medications when it comes to obesity is very, very low. Almost nobody without extremely high-end plans are getting coverage and you see more and more coverage drop in quarter-over-quarter, even in the last couple of weeks.

b. According to a study done by Blue Health Intelligence earlier this year, only 70% of patients prescribed GLP-1 medications were still using those medications after the first four weeks, and by week 12 that dropped to 42% 1 . When looking at our own data, at 4 weeks, 85% of our compounded GLP-1 users continue with their subscription. By 12 weeks, we have observed 70% of users continuing with their subscription. We believe that personalized dosages, breadth of treatment offerings, and frequent provider communication are all drivers of the early success we are seeing.

See slide 38 from the latest investor presentation - https://s27.q4cdn.com/787306631/files/doc_financials/2024/q4/Hims-Hers-Q4-FY24-Investor-Presentation.pdf

The definition of 'long term retention' is questionable, but its the only data I could find. I'm happy to be proven wrong if you have a better source for retention data. I don't currently have a position (long or short) here, so I have no dog in this fight.

Your understanding of the company's retention is way off. And if you're so off on something so fundamental to the company, it really puts your whole thesis into question.

There is virtually zero chance that 85% of customers keep their sub 2 years. And there is even less of a chance the company has ever said that either on a call or any shareholder letter/presentation.