Why Buy SPY

Now is as Good a Time as Any

Thanks to my three year old, I’ve been reading a lot of Dr. Seuss books, so this title wrote itself.

With the recent volatility in the markets, I thought it would be a good time to revisit valuing the S&P 500. The last time I went through this exercise was six months ago when the S&P was at 3600. I concluded then that the market was relatively expensive and that five year forward returns would be about 3% per year (excluding dividends). Given the market is up 16% in the last six months I was clearly very wrong.

So, what did I miss? I forecast earnings of $145 in 2021, growing to $207 by 2025. This was massively pessimistic. Consensus analyst earnings estimates for 2021 are $187, with some analysts forecasting $195. Forecasts for 2022 are $207, which was my forecast for 2025!

Obviously these estimates could be wrong, but I think they are directionally more accurate than my forecast was six months ago.

With that mea culpa out of the way, let’s get down to business.

At the end of the day there are only two numbers that drive the value of the S&P 500 - earnings and the multiple on those earnings.

Earnings

From 2004-2019, earnings grew at 6% per year on average. Note that there was a lot of variance over this period of time. For example, from 2012-2016, earnings grew 2% per year, but from 2015-2019 they grew 13% per year. This is the cyclicality that economists often refer to and predicting where we are in the cycle is a popular pastime. I’m not going to claim to have any insight on where we are in the cycle and if you have a thirty year holding period you probably shouldn’t care.

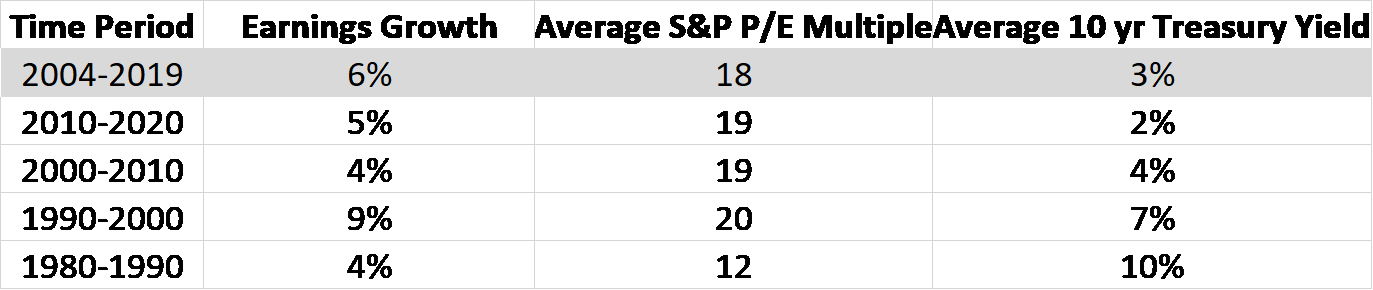

For the next decade and beyond, assuming average earnings growth of 5% a year seems reasonable to me. See the table below for some historical context.

Obviously starting and end points matter, so feel free to slice the data differently if you’d like. The model is here.

P/E Multiple

The P/E multiple for the S&P has varied widely over the last two decades with a high of 30 in 2001 and a low of 13 in 2011. Obviously 2011 was a better time to buy stocks than 2001. The average from 2004-2019 is 18. My view is that the P/E should vary somewhat depending on interest rates. In the 80s when 10 year treasuries averaged 10%, the average P/E was 12. In the 2010s when the 10 year averaged 2%, the average P/E was 19.

If you believe that we’re in a slower growth, low inflation world (my opinion, but not a popular one at the moment), then an average P/E of 20 seems reasonable to me. You could argue for a higher P/E given the 10 year treasury yield is currently below 2%, but rates can move quickly as we’ve seen in the last 6 months. You could also argue for a lower P/E if you believe inflation is going to pick up and 10 year yields are going to be at 4-5%.

S&P 500 Valuation

Based on the above, the S&P would be fairly valued at about 3750 and is slightly overvalued today. However if your time horizon is 10 years or longer, this small over valuation is probably not relevant. Assuming earnings grow at 5% for the next decade and the P/E ratio in 2030 is 20, you can expect about 5% per year if you buy the S&P today (including dividends).

The only thing I’m trying to avoid by doing this analysis is buying the S&P when its outrageously expensive. You could argue that even this is foolish if you have a thirty year holding period, because in the long term, the returns on the index are going to equal earnings growth, so over paying doesn’t matter much. That said, there was a thirteen year period from 1999 to 2012, where you would have made no money holding the S&P. This would have made it hard to stick to a buy and hold strategy with the S&P 500, so I believe price matters.

TLDR – this is neither a good time nor a bad time to buy the S&P, so buying on dips like we had two days ago is probably a good strategy if you’ve got a long holding period.

Notes

There’s a good chance earnings grow more quickly in the short term than I’m modeling for a few reasons -

1. Tech companies now dominate that S&P 500, and the biggest of these are not showing any sign of slowing earnings growth.

2. Tech companies make a significant portion of their revenue internationally (over 50% for Google as an example), so even if U.S. GDP growth is not strong for the next decade, earnings growth for the tech companies could still be.

3. In the short term, financials, healthcare and consumer discretionary stocks could all see an earnings boost from rising rates, a return to elective medical care, and increased consumer spending respectively. My sense is a lot of this is already baked into the $187 consensus earnings forecast for 2021, but I could still see a positive surprise.

I prefer to own the S&P 500 through VOO vs SPY because it has a lower expense ratio (.03% vs .09%).